Old Idea, New Insights: The Ricardian Revival in International Trade

NBER Reporter 2017 Number 3

Old Idea, New Insights: The Ricardian Revival in International Trade

Arnaud Costinot and Dave Donaldson

Arnaud Costinot is a research associate in the NBER International Trade and Investment Program. A professor of economics at MIT, he received his B.S. from École Polytechnique in 2000, his M.A. from École des Hautes Études en Sciences Sociales in 2001, and his Ph.D. from Princeton University in 2005. He is a co-editor of the Journal of International Economics, a foreign editor of the Review of Economic Studies, and an associate editor of the American Economic Review and the Journal of Economic Literature.

His research has focused on a variety of positive and normative issues in international trade, including the foundations of the theory of comparative advantage, the measurement of the welfare gains from trade, the role of intermediaries in international exchanges, the impact of global supply chains, and the design of optimal trade policy and capital controls.

Costinot grew up in Dunkirk, in the north of France. He currently lives in Brookline, Massachusetts, with his wife, Nadège, and their two children, Paul and Alice.

Dave Donaldson is a research associate in the NBER's Development Economics, Development of the American Economy, and International Trade and Investment Programs, and a professor of economics at MIT. He is a co-editor of the American Economic Journal: Applied Economics, an editorial board member of the Journal of Economic Literature, the Journal of International Economics, the Review of Economic Studies, and the Quarterly Journal of Economics, and a program director (for trade) at the International Growth Centre.

Donaldson has investigated the welfare and other effects of market integration, the impact of improvements in transportation infrastructure, how trade can mediate the effects of climate change, and how trade affects food security and famine. He has been awarded the 2017 John Bates Clark Medal, as well as an Alfred P. Sloan Research Fellowship, and has benefited from support from the National Science Foundation.

Donaldson is a native of Toronto. He received an undergraduate degree in physics from the University of Oxford and a Ph.D. from the London School of Economics. He lives in Boston with his wife, daughter, and three sons.

Two centuries ago, David Ricardo wrote down a simple thought experiment that changed the way economists think about international trade. Suppose the residents of two nations, England and Portugal, differ in their ability to produce two goods, cloth and wine: Portugal is more efficient at both, but its relative advantage over England is weaker in cloth. If these countries are able to trade, what will happen? Who will trade what with whom? Who will gain from the trades? How large will the gains be?

Ricardo's famous example has been used to answer these fundamental questions of international trade in countless text-books: England imports Portuguese wine and everyone's a winner, all the more so the worse the English are at making wine.

Until recently, however, Ricardo's logic has had surprisingly little impact on the way that economists use data from the world around them to answer questions about trade policy. Extending the logic to a realistic economy with many regions and products had seemed somewhere between impractical and impossible. But thanks to a number of recent innovations — most importantly in the seminal work of Jonathan Eaton and Samuel Kortum — this is rapidly changing.1 In this research report, we describe some of our recent attempts to connect Ricardo's 200-year-old idea to the real world.

Ricardian Comparative Advantage and Empirical Patterns of Trade

We begin by asking the most basic of empirical questions: How well do the predictions of a Ricardian model line up with data on trade patterns? In a famous challenge, a mathematician, Stan Ulam, once asked Paul Samuelson to name one proposition in the social sciences that is both true and nontrivial. After much reflection, Samuelson's reply was: "Ricardo's theory of comparative advantage."

The practical content of Ricardo's theory has received surprisingly little attention due to the challenges of connecting Ricardo's ideas to data. Together with Ivana Komunjer, we have extended Eaton and Kortum's quantitative model to study inter-industry Ricardian comparative advantage in a way that is amenable to empirical scrutiny.2

The basic prediction of the Ricardian model is that countries should export relatively more in sectors in which they are relatively more productive. Our model captures this simple idea by providing closed-form solutions for relative bilateral trade flows as a function of relative observed productivity. Crucially, the model takes into account the fact that countries will not produce all varieties of every good. Rather, a country will only produce those varieties in which it is relatively more efficient. This implies that differences in observed productivity tend to be smaller than true differences in productivity as a result of a selection effect.

Combining standard data on industry-level trade flows and productivity, we find that countries do indeed tend to export goods where their relative productivity is higher, as this Ricardian model would predict. More precisely, a 1 percent change in relative productivity is associated with a 6.5 percent change in relative exports. There is also support for the notion that observed productivity differences are biased by Ricardian selection. We use our estimates to quantify the welfare impact of this Ricardian channel across sectors. Cross-industry differences in technologies generate only a small part of the gains from trade; comparative advantage operates mostly at the within-industry product level.

Ricardo's Difficult Identification Problem

"Ricardo's difficult idea," as Paul Krugman once referred to the theory of comparative advantage, contains at its core a fundamental barrier to empirical analysis. Ricardo's simple example involved a prediction about trade patterns as a function of four productivity numbers — England's and Portugal's productivity levels in cloth and wine. But how is an analyst to measure England's productivity in an activity, such as wine making, which it does not engage in because it can import wine from Portugal? Without knowledge of this missing productivity number, it is impossible to test the model's predictions about the patterns of trade. Yet the very essence of the model implies that this fourth number should not be observable to an analyst.

This empiricist's Gordian knot — formally, an "identification" problem — is familiar in selection models throughout economics, but standard solutions have been difficult to apply to the study of international trade. Previous attempts to test the Ricardian theory, including our aforementioned paper, are therefore based on strong functional-form assumptions that impose a particular structure on the distribution of productivity across goods (and varieties of the same good) to allow an analyst to infer underlying productivity differences from observed differences.

In recent research, we have drawn on some unique features of the agricultural sector in order to make progress on Ricardian empirical work despite the identification challenges. The key observation is that this is a setting in which a major scientific focus among agronomists is to predict the productivity, for any crop, that any location could achieve as a function of its environmental conditions. For example, the Global Agro-Ecological Zones (GAEZ) project from the Food and Agricultural Organization aggregates such predictions for all major crops and at a detailed geographical level. The project includes information on 2.2 million parcels of land around the globe. This permits one to "observe" not only the productivity of a land parcel in its current use, but also in all potential uses.

In a first paper, we focused on a direct test of the Ricardian model.3 On the basis of GAEZ potential yield observations, we calculated the Ricardian model's predictions about the pattern of production — which crops growers at different locations would choose to specialize in, at prevailing producer prices. These predicted patterns of production have significant power to predict actual patterns of crop production around the world — perhaps surprisingly so, given the many reasons for actual productivities to differ from those predicted by agronomists.

Moving beyond testing, a core interest is in estimating the gains from trade that exist in the world around us. As in all standard trade models, the Ricardian model postulates that regions differ and those differences give rise to potential gains from specialization afforded by the ability to trade. But how large are the differences, and hence how large are the gains? Unfortunately Ricardo's identification problem again stands in the way. All four of Ricardo's numbers are needed to evaluate the gains from trade, for either England or Portugal. The key is to estimate just how much more efficient the world is when England doesn't have to produce any wine. That efficiency boost depends on how bad England is at producing the wine that it doesn't produce.

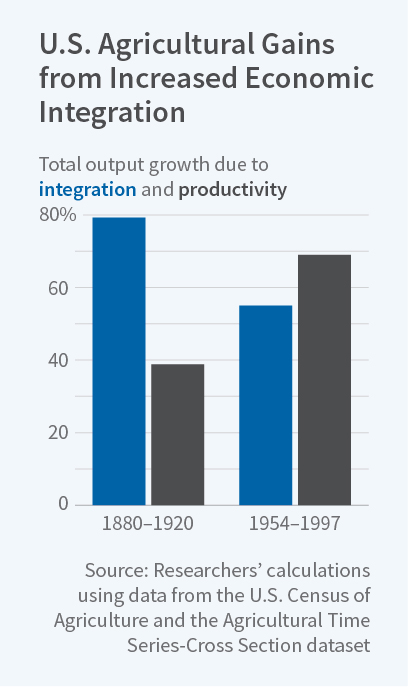

In a second recent paper, we again draw on the GAEZ data to measure some of the gains from agricultural trade.4 In particular, we ask how much of the growth in U.S. agricultural productivity over the period 1880–1997 has come about because of the spatial integration of agricultural markets across the United States. A key challenge to incorporating information from the GAEZ data in this historical case is that potential yields, for each crop in each location, have changed, in unknown ways, due to technological progress. But under the assumption that those changes do not reverse comparative advantage within any county, we show how to use data from the Agricultural Census since 1880 to infer the unique set of prices and productivity shocks that is consistent with profit maximization and factor-market clearing in any given county and year. These estimated, model-consistent prices correlate well with data on actual state-level prices and show a clear trend toward lower intra-U.S. spatial price dispersion over time. Commodity markets were more integrated in 1997 than in 1880.

But how large are the benefits from this heightened integration? To shed light on this question, we calculate the change in the value of nationwide output that the 1880 economy would have enjoyed if inter-spatial price gaps in 1880 were set to their later (say 1920) level, rather than to the actual 1880 level. The results are surprising. For example, 1880–1920 gains were 79 percent, approximately the same as the gains that we calculate are due to pure within-location productivity gains. Similar statements are true about a later period, 1954 to 1997. Overall, the increasing exploitation of gains from intra-national trade in this context appear to have been a major, and perhaps underappreciated, contributor to aggregate economic growth.

Comparative Advantage and the Costs of Climate Change

Together with Cory Smith, we have also applied Ricardo's logic to study of the consequences of climate change in agricultural markets around the world.5

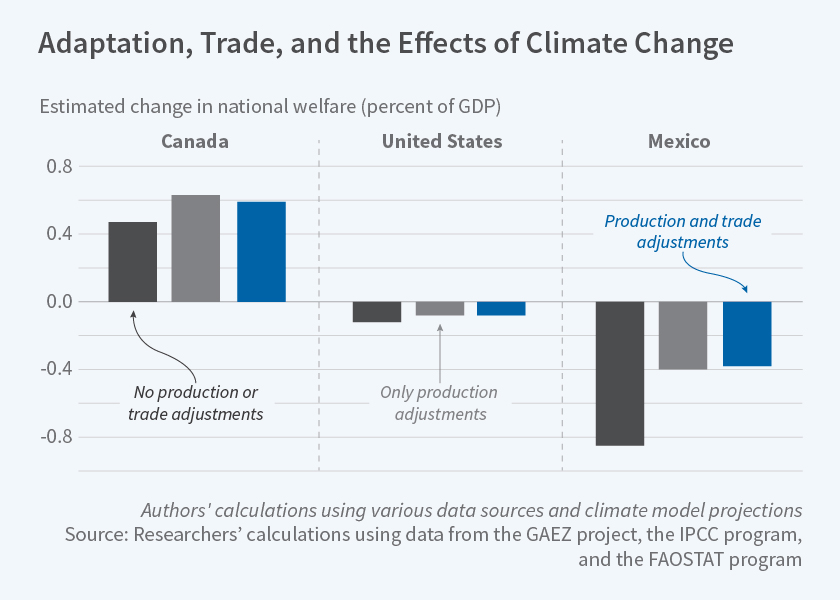

There is little doubt that a warming climate will portend lower yields for many crops in many locations. But the aggregate consequences of those millions of micro-shocks will depend on the extent to which farmers can shift their growing patterns from one crop to another, and the extent to which consumers can change the trade linkages that connect them to particular farmers.

To examine these possibilities we build a general equilibrium model of trade, in 10 leading crops, among each of 1.7 million land parcels around the world. Each parcel has its own Ricardian productivity capabilities in each crop, so we have 17 million crop-parcel estimates, and trade occurs subject to trading frictions designed to match world trade flows today. We then shock each parcel's productivity level in each crop in the manner that climatologists and agronomists believe will arise due to climate change by 2071–2100. This is feasible because the GAEZ project provides their agronomic predictions both for contemporary climate conditions and also under the expected climate conditions that correspond to each of the scenarios used by the UN's Intergovernmental Panel on Climate Change.

What are the consequences of this change in the 17 million place- and crop-specific productivities? We find that climate change would generate a large negative productivity shock for many countries around the world and that if there were no real-locations around the world, welfare would decrease substantially. The value of crop output would be predicted to fall by about 40 percent. However, there is enough heterogeneity in these shocks over space that after reallocating production according to comparative advantage across crops within each parcel, welfare losses become smaller by a factor of three. Furthermore, there is so much productivity heterogeneity across parcels within countries that there is little to be gained from controlling countries' capacity to adjust their trade flows internationally.

Reducing Ricardian Complexity

The Ricardian world can be a complicated place. The full equilibrium implications of Ricardo's four numbers, in his simple two-by-two setting, took almost three decades to work out, as John Stuart Mill did in 1844.6 So what is the Ricardian analyst — let alone the reader — to make of the complexity of a model like that discussed above with 17 million productivity ingredients? In recent work with Rodrigo Adao, we have developed a new methodology for simplifying the empirical use of general neoclassical models, a class that includes the Ricardian model as a special case.7

We first establish the equivalence between such models and reduced exchange models in which countries directly exchange factor services, extending an original insight from Charles Wilson in the Ricardian case.8 This equivalence implies that, for an arbitrary change in trade costs, counterfactual changes in the factor content of trade, factor prices, and welfare only depend on the shape of a reduced factor demand system. We then provide sufficient conditions for estimates of this factor demand system to be recovered non-parametrically. Together, these results offer a strict generalization of the parametric approach used in so-called gravity models — like the version of the Ricardian model developed by Eaton and Kortum — in which the factor demand system is isoelastic.

Implications for Optimal Trade Policy

What does the Ricardian model imply for the design of a nation's optimal trade policy? Should it protect more import sectors with weaker comparative advantage? Conversely, should it subsidize less in export sectors with stronger comparative advantage? Perhaps surprisingly, in spite of the importance of the theory of comparative advantage in the field of international trade, these questions have not previously been investigated formally. The goal of our work with Jonathan Vogel and Iván Werning is to shed light on these questions.9

The main theoretical result of our paper is that, in the context of a canonical Ricardian model, optimal import tariffs should be uniform, whereas optimal export subsidies should be weakly decreasing with respect to comparative advantage. While the latter pattern accords well with the observation that countries tend to protect their least competitive sectors in practice, larger subsidies do not stem from a greater desire to expand production in less competitive sectors. Rather, they reflect tighter constraints on the ability to exploit monopoly power by contracting exports. Put simply, countries have more room to manipulate world prices in the sectors in which they have a comparative advantage.

The final part of the paper explores the quantitative importance of these theoretical considerations in the agricultural sector. The market structure in this sector is plausibly close to the neoclassical ideal and, again, agronomic data enable a unique view of comparative advantage. We find that about half of the welfare gains from optimal trade taxes arise from the use of non-uniform trade taxes that vary monotonically with comparative advantage.

Home Demand as a Source of Ricardian Comparative Advantage

In more recent work we have turned to a more basic question: Where do Ricardo's cross-country differences in relative productivities come from? In models that incorporate increasing returns, be they of the Marshallian sort that are external to firms or of the monopolistic competition sort that play out through firm entry in differentiated product markets, the productivity of a given industry in a given nation rises as its output increases. This opens up the possibility, for sufficiently strong aggregate economies of scale, of what Staffan Linder and Krugman call the "home-market effect," in which a region's home demand base will become a source of endogenous Ricardian comparative advantage.10

In work with Margaret Kyle and Heidi Williams, we estimate the strength of this effect in the context of the global pharmaceutical industry.11

Building on previous work on the effect of demographic changes on innovation and product entry by Daron Acemoglu and Joshua Linn,12 our paper establishes that countries that for demographic reasons are expected to have high demand for a certain type of drug are actually more likely to be net exporters of that drug. We find that the correlation between predicted home demand and sales abroad is positive and greater than the correlation between predicted home demand and purchases from abroad, which is strong evidence for the role of the home market in creating comparative advantage.

Ricardo's Rejuvenation

New data sources, new modeling strategies, and new empirical procedures have breathed new life into Ricardo's 200-year-old insights about comparative advantage and trade flows. This revitalized line of work has generated important insights on a range of applied questions, including the design of border taxes, the origins of aggregate productivity gains, and the expected harm from climate change. We have recently surveyed many of these new developments.13 The impact of Ricardo's path-breaking work may be even greater in its third century than in its first two.

1. J. Eaton and S. Kortum, "Technology, Geography, and Trade," Econometrica, 70(5), 2002, pp. 1741-79.

↩

2. A. Costinot, D. Donaldson, and I. Komunjer, "What Goods Do Countries Trade? A Quantitative Exploration of Ricardo's Ideas," NBER Working Paper No. 16262, August 2010, and Review of Economic Studies, 79(2), 2012, pp. 581-608.

↩

3. A. Costinot and D. Donaldson, "Ricardo's Theory of Comparative Advantage: Old Idea, New Evidence," NBER Working Paper No. 17969, April 2012, and American Economic Review Papers and Proceedings, 102(3), 2012, pp. 453-8.

↩

4. A. Costinot and D. Donaldson, "How Large Are the Gains from Economic Integration? Theory and Evidence from U.S. Agriculture, 1880-1997," NBER Working Paper No. 22946, December 2016.

↩

5. A. Costinot, D. Donaldson, and C. Smith, "Evolving Comparative Advantage and the Impact of Climate Change in Agricultural Markets: Evidence from 1.7 Million Fields Around the World," NBER Working Paper No. 20079, April 2014, and Journal of Political Economy, 124(1), 2016, pp. 205-48.

↩

6. J. S. Mill, Essays on Some Unsettled Questions in Political Economy, London: Longmans, Green, Reader, 1844; and Dyer, 2nd edition, 1874.

↩

7. R. Adao, A. Costinot, and D. Donaldson, "Nonparametric Counterfactual Predictions in Neoclassical Models of International Trade," NBER Working Paper No. 21401, July 2015, and American Economic Review, 107(3), 2017, pp. 633-89.

↩

8. C. Wilson, "On the General Structure of Ricardian Models with a Continuum of Goods: Applications to Growth, Tariff Theory, and Technical Change," Econometrica, 1980, 48(7), pp. 1675-702.

↩

9. A. Costinot, D. Donaldson, J. Vogel, and I. Werning, "Comparative Advantage and Optimal Trade Policy," NBER Working Paper No. 19689, December 2013, and Quarterly Journal of Economics, 130(2), 2015, pp. 659-702.

↩

10. S. Linder, An Essay on Trade and Transformation, Uppsala, Sweden: Almqvist & Wiksells, 1961; P. Krugman, "Scale Economies, Product Differentiation, and the Pattern of Trade," American Economic Review, 1980, 70(5), pp. 950-9.

↩

11. Costinot, D. Donaldson, M. Kyle and H. Williams, "The More We Die, the More We Sell? A Simple Test of the Home-Market Effect," NBER Working Paper No. 22538, August 2016.

↩

12. D. Acemoglu and J. Linn, "Market Size in Innovation: Theory and Evidence from the Pharmaceutical Industry," NBER Working Paper No. 10038, October 2003, and Quarterly Journal of Economics, 2004, 119(3), pp. 1049-90.

↩

13. A. Costinot and J. Vogel, "Beyond Ricardo: Assignment Models in International Trade," NBER Working Paper No. 20585, October 2014, and Annual Review of Economics, 7, 2015, pp. 31-62; D. Donaldson, "The Gains from Market Integration," Annual Review of Economics, 7, 2015, pp. 619-47.

↩