NBER Reporter 2013 Number 3: Research Summary

Inflation-Indexed Bonds

Luis M. Viceira *

Introduction

Inflation-linked bonds, which in the United States are known as Treasury Inflation Protected Securities (or TIPS), are bonds that pay investors a fixed inflation-adjusted coupon and principal. Their nominal payments adjust automatically with the evolution of a price index describing the cost of a basket of consumer goods such as the Consumer Price Index in the United States. Although the popular press often labels inflation-indexed bonds as "exotic securities," nothing could be farther from reality.

Inflation-indexed bonds constitute today a significant fraction of outstanding bonds issued by the U.S. Treasury—around 10 percent of total marketable debt, and more than 3.5 percent of GDP. Both institutional investors such as endowments and pension funds and retail investors hold them in their portfolios, either directly or indirectly through TIPS mutual funds, exchange-traded funds (ETFs), and asset allocation funds such as target retirement funds. TIPS have become a building block of investors' portfolios. TIPS also play an important role in policy. Central bankers, professional economists, and market observers routinely follow the evolution of "breakeven inflation," or the spread between the yields on nominal government bonds and the yields on inflation-indexed bonds of equivalent maturity, as an indicator of real-time inflation expectations from bond market participants.

The relevance of inflation-indexed bonds to investors and policymakers is not unique to the United States. The United Kingdom has a longer and even more established tradition of issuing and investing in inflation-linked bonds (or "gilts" as government bonds are known in the United Kingdom). Inflation-indexed linkers represent more than 30 percent of British public debt, equivalent to almost 10 percent of UK GDP. The UK government is now considering issuing inflation linkers with super-long maturities (in excess of 50 years) and even perpetual inflation-indexed gilts. In the Euro area, France, Germany, and Italy regularly issue inflation linkers, linked to either Euro-area inflation or to domestic inflation. Demand for linkers in both the United Kingdom and the Euro area is strong, particularly from pension funds, as pensions in those countries are typically indexed to inflation. After a brief interruption, Japan is re-starting regular issuance of inflation-linked bonds and, among emerging economies, Brazil has become a large issuer of such bonds. Australia, Canada, Chile, Israel, Mexico, Turkey, and South Africa are also economies with non-trivial issuance of inflation linkers. The hedge fund Bridgewater has recently calculated the size of the global inflation-linked market at $2.5 trillion, larger than the high-yield corporate bond market and twice as large as the dollar-denominated emerging market bond market.

My research on inflation-indexed bonds has been focused on understanding the role of these securities in investors' portfolios, their pricing and risk, and the impact of institutional factors on the market for inflation-indexed bonds.

Inflation-Indexed Bonds in Long-Term Portfolios

A traditional idea in investment practice is that cash (for example, short-term default-free bonds or bills) is the safe asset for all investors. This idea is rooted in a perception that real interest rates are constant. Indeed, if real interest rates are constant, standard models of portfolio choice, whether static or dynamic, show that the optimal investment strategy for investors with low (effectively zero) risk tolerance is a strategy of constantly reinvesting their wealth in default-free real short-term bonds. To the extent that inflation risk is small at short horizons, nominal short-term bonds are good substitutes for inflation-indexed short-term bonds.

My early research on inflation-indexed bonds with John Campbell shows that this strategy will not be optimal if ex-ante real interest rates vary over time.1 When future real interest rates uncertain a strategy of constantly reinvesting wealth in short-term bonds will preserve investors’ initial wealth in the face of random shocks to long-term assets, but not necessarily their ability to spend out of this wealth.2 If real interest rates decline, investors will have to either adjust downward their spending plans to accommodate this reduction in the yield on their wealth, or else deplete part of their wealth to maintain their consumption plans, with the subsequent impact that this reduction in wealth might have on their future welfare.

In contrast to a strategy of constantly reinvesting wealth in short-term bonds, a strategy of investing in inflation-indexed long-term bonds will protect spending, since these bonds will increase in value as real interest rates decline, thus providing the extra cushion investors need to maintain their spending plans without depleting their initial principal. For long-horizon investors, long-term inflation-indexed bonds are the riskless asset. By investing in a portfolio of inflation-indexed bonds whose cash flows match their consumption spending plans, investors can guarantee a riskless consumption stream.3 Of course, this portfolio of inflation-indexed bonds will experience short-term fluctuations in price, but these will be irrelevant to a long-horizon investor exclusively interested in ensuring a riskless consumption stream.

Our analysis provides support for the traditional portfolio advice that conservative long-term investors should tilt their portfolios toward long-term bonds. However, it does so with an important qualification: the bonds should be inflation-indexed. Nominal long-term bonds such as Treasury bonds and notes expose long-term investors to inflation risk. If realized inflation turns out to be larger than expected at the time of the investment in nominal bonds, the ability of those bonds to protect real spending will be undermined. By contrast, inflation-indexed bonds are immune to the potentially devastating effects of unexpected inflation.

The insights of this analysis have important implications for the design of savings vehicles for long-term investors, such as investors saving for retirement. It makes clear that assets that preserve capital do not necessarily preserve long-term standards of living. Long-term inflation-indexed bonds, not cash instruments, are the riskless asset for conservative investors who care about financing their long-term spending plans or liabilities, such as investors saving for retirement, traditional pension funds, or endowments. Nominal long-term bonds achieve this objective only when inflation risk is low. The issuance of inflation-indexed bonds by the Treasury has a significant impact on welfare, as it provides long-term investors with a truly riskless long-term investment vehicle.

Real Interest Risk, Inflation Risk, and the Risk of Long-Term Bonds

Inflation-indexed bonds are the safe asset for long-term investors. But how much riskier is investing in short-term bonds or in long-term nominal bonds from the perspective of a long-horizon investor? Or the risk of investing in long-term inflation-indexed bonds from the perspective of a short-horizon investor? To answer these questions, one can apply the tools of modern finance to the analysis of inflation and interest rates to quantify real interest rate risk and inflation risk.

A simple and intuitive way to understand the importance of these two types of risk is to examine the annualized standard deviation (or volatility) across investment horizons of the real return on a strategy consisting of constantly reinvesting capital in Treasury bills, and the real return on another strategy consisting of buying and holding a long-term zero-coupon nominal bond with maturity equal to each investment horizon under consideration. 5 To the extent that short-term inflation risk is modest, the only uncertainty about the long-horizon real return on a strategy of rolling over Treasury bills is the real rate at which the capital will be reinvested. Therefore, this strategy exposes long-horizon investors to real interest rate risk. By contrast, the real return on a default-free zero-coupon nominal bond equals the inverse of cumulative inflation over the life of the bond. Therefore, the strategy of investing in a variable maturity nominal bond exposes investors to inflation risk at different horizons.

Figure 1 shows the annualized standard deviation of the real return on each strategy across investment horizons. The standard deviation is based on estimates of a VAR(1) model for quarterly bond returns and interest rates for the period 1952-2011. This figure shows that the real return on both strategies exhibits significant "mean-aversion"; that is, the real return volatility on both strategies increases significantly with the investment horizon. The mean aversion of Treasury bill returns is caused by persistent variation in the real interest rate in the postwar period, which amplifies the volatility of returns when Treasury bills are reinvested over long horizons. The mean aversion of the variable-maturity bond is the result of persistent variation in inflation in the postwar period. A positive shock to inflation that lowers the real return on a long-term nominal bond is likely to be followed by high inflation in subsequent periods as well, and this amplifies the annualized volatility of a long-term nominal bond held to maturity. In relative terms, Figure 1 suggests that inflation risk makes a strategy of buying and holding long-term nominal bonds riskier than a strategy of rolling over Treasury bills at all horizons.

(pdf)

(pdf)

Figure 1 illustrates the long-term implications of persistent variation in inflation and real interest rates for risk, and it helps explain why long-horizon investors should view cash and nominal bonds as risky assets. By contrast, a strategy of investing in a variable-maturity inflation-indexed bond would exhibit zero volatility at each horizon; that is, it would overlap with the horizontal axis on Figure 1.

We can use modern arbitrage-free factor models of the term structure of interest rates to estimate and characterize real interest rate risk and inflation risk embedded in bond prices and returns. I have conducted such analysis in several papers jointly written with John Campbell, Robert Shiller, and Adi Sunderam.7 My early work on inflation-indexed bonds with John Campbell formulates an affine two-factor term structure model in which one factor is the log real interest rate and the other the log expected rate of inflation. An estimation of the model using nominal bond yields and realized inflation for the United States shows that both factors exhibit substantial persistence and variability over the post-World War II period. The unconditional volatility of the ex-ante real short-term interest rate is about 1 percent per annum (p.a.), almost as large as its unconditional mean of 1.4 percent p.a. The estimated inflation risk premium in ten-year nominal bonds is fairly large, at 1.1 percent p.a. These estimates suggest that conservative investors would have benefited substantially from the consumption insurance provided by long-term inflation-indexed bonds if offered during this period, while they would have been exposed to significant long-term risk if they had invested in either cash instruments or long-term nominal bonds.

By contrast, an estimation of the model for the post-1983 period spanning the Federal Reserve chairmanships of Paul Volcker and Alan Greenspan shows a significant decline in the persistence of expected inflation and an increase in the persistence of the real interest rate relative to the entire postwar period. These results are consistent with the notion that since the early 1980s the Federal Reserve has controlled inflation more aggressively at the cost of greater long-term variation in the real interest rate. Lower persistence in expected inflation implies lower inflation risk and a lower inflation risk premium in nominal bonds, which over this period become closer substitutes of inflation-indexed bonds. Indeed, in recent years the short-run volatility of TIPS and Treasury bond returns in the United States has been very similar, and the correlation of their returns has also increased significantly, suggesting that variation in real interest rates has been an important source of variation in bond yields and returns. The UK gilt market exhibits a similar pattern.

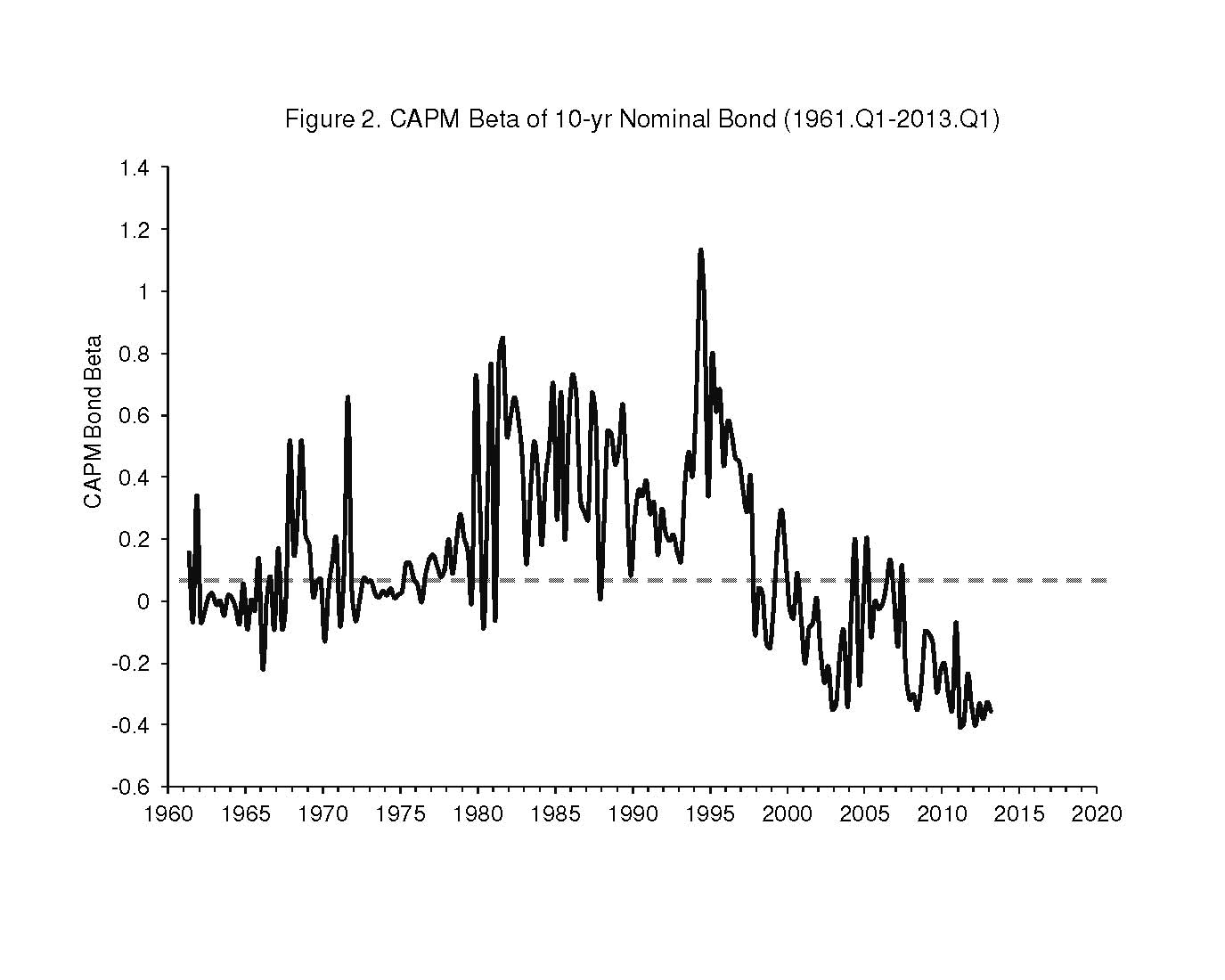

The contrast between the estimates of the real interest rate and expected inflation process for the post-war period and the Volcker-Greenspan sub-period suggests that real interest rate risk and inflation risk might not be constant. Indeed a measure of the systematic risk of nominal bonds such as the covariance of nominal bond returns with aggregate stock returns — or a normalized version of it such as beta or correlation — exhibits considerable low frequency variation over time, even switching its sign, as shown in Figure 2.8 The CAPM beta of nominal long-term bonds was low or negative on average in the period leading to the run-up in inflation in the late 1970s, was highly positive on average during the 1980s into the second half of the 1990s, and it has been negative since. As the nominal bond-stock covariance declines, nominal bonds become less risky assets since their ability to diversify aggregate stock market risk increases.

(pdf)

(pdf)

Long-term nominal bond returns respond to both real interest rates and to expected inflation. A natural question is whether the pattern shown in Figure 2 reflects a changing covariance of real interest rates with the stock market, or a changing covariance of inflation with the stock market. An examination of the CAPM beta of inflation-indexed bonds and the CAPM beta of breakeven inflation returns — the return on a long-short portfolio, long inflation-indexed bonds and short nominal bonds of equivalent duration — over the period that starts in 1997 suggests that the decline in nominal bond risk in recent years has been the result of a decline in both the real interest risk and the inflation risk of nominal bonds.9

The covariance of inflation-indexed bond returns with stock returns has been negative over this period, implying that real interest rates have been positively correlated with stock returns. The covariance of breakeven inflation returns with stock returns has been positive on average over the same period, implying that inflation has also been positively correlated with stock returns. A positive correlation of either real interest rates or inflation with stock returns makes nominal bond returns negatively correlated with stock returns, since nominal bond prices move inversely with changes in real interest rates and inflation. Although it is not possible to estimate the covariance of nominal indexed-bond returns with stock returns before they were first issued in 1997, we can still estimate the conditional covariance of stock returns with realized inflation. An estimate of this covariance shows a mirror image of Figure 2. 10 It was mildly positive on average during the 1960s into the 1970s, negative during the late part of the 1970s into the mid 1990s, and it has been strongly positive since the mid-1990s. This estimate suggests that changing inflation risk (that is, a changing covariance of inflation with stock returns) has been an important contributor to the changing nominal bond-stock covariance in the long run.

We observe similar patterns for the UK gilt market, for which we have a longer history of inflation-linked bond returns dating back to the 1980s. The covariance of stock returns with nominal bond returns and inflation-linked bond returns was positive into the late 1990s and it has been negative since; the covariance of stock returns with breakeven inflation returns was negative into the late 1990s, implying positive inflation risk, and it has been positive since. 11 These patterns suggest a decline in both real interest rate risk and inflation risk since the mid-1990s in both the United States and the United Kingdom.

The negative covariance of inflation-indexed bond returns with stock returns in the United States and the United Kingdom during this period implies that inflation-indexed bonds have provided equity investors with an important diversifier of stock market risk, in addition to providing (by construction) long-term conservative investors with the safe asset. The negative covariance of nominal bonds with stock returns, and the positive covariance of breakeven inflation returns with stock returns imply that nominal bonds have also provided equity investors with an important diversifier of stock market risk, and long-term conservative investors with a close substitute of inflation-indexed bonds over this period.

Arguably the period since the late 1990s has been a period during which demand shocks have been the main driver of inflation and also a period of strong central bank credibility, with stable inflation expectations. Under those circumstances, inflation is likely to be pro-cyclical and nominal bond returns negatively correlated with stock returns. The negative covariance of inflation-indexed bond returns with stock returns implies that real interest rates have been pro-cyclical over this period. In fact, the yields on TIPS have been slightly negative during the last recession, and have increased and turned positive only recently as the U.S. economy has strengthened. The evolution of inflation-indexed bond yields is consistent with asset pricing models in which investors exhibit countercyclical risk aversion, driving the price of the long-term safe asset up in recessions as their tolerance for risk declines, and down in expansions as they become more risk-tolerant. 12

To the extent that these factors remain in place, we should expect inflation-indexed bonds and nominal bonds to remain negatively correlated with aggregate stock returns, and for nominal bonds to remain close substitutes of inflation-indexed bonds. However, if inflation turns again countercyclical as it was in the stagflationary period of late 1970s and 1980s, nominal bonds will become risky assets positively correlated with stock returns and poor substitutes of inflation-indexed bonds.

Inflation-Indexed Bond Return Predictability and the Expectations Hypothesis of Real Interest Rates

The changing covariance of inflation-indexed and nominal bond returns with stock returns raises the question of what these changes in magnitude and switches in sign of the quantity of bond risk imply for bond risk premia and the shape of the term structure of real and nominal interest rates. In recent research with John Campbell and Adi Sunderam I have explored this question using a quadratic model of the term structure of interest rates that incorporates macroeconomic factors—real interest rates and expected inflation—along with a state variable driving the variance of real and nominal interest rates and their covariance with the macroeconomy. 13 This model is one the first asset pricing models that try to jointly explain the time variation in multiple asset classes along with the time variation in the co-movement of their returns.

The model generates time-varying real interest rate risk and inflation risk, predicting positive nominal bond risk premia in the early 1980s, when bonds covaried positively with stocks, and negative risk premia in the 2000s and particularly during the downturn of 2007-09, when bonds hedged equity risk. An interesting implication of the model is that a strongly concave yield curve should predict high excess bond returns. In the model, a high bond-stock covariance is associated with a high volatility of bond returns. The high bond-stock covariance generates a high term premium and a steep yield curve at maturities of one to three years, while the high bond volatility lowers long-term yields through a Jensen's inequality or convexity effect. Thus, the concavity of the yield curve is a good proxy for the bond-stock covariance. In this fashion, the model explains the qualitative finding of prior research that a tent-shaped linear combination of nominal forward rates predicts excess nominal bond returns at all maturities.14

This model of the term structure of interest rates with a time-varying quantity of bond risk however does not generate enough variability in nominal bond risk premia (or expected nominal bond excess returns) to match the variability uncovered by predictive regressions of nominal bond excess returns on lagged nominal yield spreads and forward rates. 15 Thus, while a time-varying quantity of bond risk is a stylized empirical fact that asset pricing models need to incorporate, it is not enough to fully explain the estimated variability in nominal bond risk premia. Asset pricing models that attempt to fully explain bond return predictability need to consider additional factors such as a time-varying aggregate price of risk or a time-varying volatility of aggregate consumption growth.

The high explanatory power of nominal bond return predictive regressions has raised questions about whether the expectations hypothesis of interest rates—the hypothesis that the yields on long-term bonds reflect expectations of future short-term interest rates plus a constant risk premium—holds for U.S. nominal bonds. Under the expectations hypothesis, expected excess returns on bonds are constant over time, and no state variable should be able to predict bond excess returns.

A natural question to ask then is whether we also observe time-series variability in expected excess returns on inflation-indexed bonds and, if so, how large it is and what drives it. I have explored these questions in my most recent research on inflation-indexed bonds with Carolin Pflueger. 16 Our research finds that, despite the relatively short history of inflation-indexed bonds in the United States, there is strong evidence that their returns are predictable. This evidence of return predictability extends to UK inflation-indexed bonds, for which we have a longer history of yields and returns. Specifically, our research finds that the yield term spread (the difference between the yield on a long-dated bond and a short-dated bond) on inflation-indexed bonds forecasts positively the return on inflation-indexed bonds, just like the yield term spread on nominal bonds forecasts positively the return on nominal bonds.

We also find strong evidence that the difference between the nominal yield term spread and the inflation-indexed bond yield term spread, or equivalently the spread between breakeven inflation in long-dated bonds and breakeven inflation in short-dated bonds, also forecasts positively the return differential between nominal bonds and inflation-indexed bonds. In other words, controlling for the predictability of returns on inflation-indexed bonds, nominal bond returns still exhibit "excess predictability."

Institutional Factors and the Market for Inflation-Indexed Bonds

It is tempting to interpret the variation in the expected return on inflation-indexed bonds as evidence in expected return space of time variation in real interest risk premia, and the variation in the expected return on nominal bonds in excess of inflation-indexed bonds as evidence of time variation in inflation risk premia.

However, this interpretation is problematic if the yields on inflation-indexed bonds are imperfect proxies for the true real interest rates in the economy. There are several reasons why the yields on TIPS can diverge from true real interest rates. First, the principal and thus the nominal coupons on TIPS adjust to inflation only with a three-month lag, and principal adjustments are taxed as ordinary income. Lagged indexation is unlikely to be a relevant issue in practice, as US inflation exhibits very low variability at short horizons. But taxation could possibly be relevant to the extent that the marginal investor in TIPS is a taxable investor, although the empirical evidence on holdings suggests that a large fraction of TIPS outstanding is held by tax-exempt institutional investors such as pension funds and endowments, and by taxable investors in tax-exempt accounts such as retirement plans.

Second, the principal at issuance on TIPS is protected against deflation. Thus the yields on TIPS will include a discount relative to true real interest rates, reflecting the value of this deflation put. In practice this deflation put is unlikely to be valuable for most TIPS except for those most recently issued—and in that case the value of the option will depend on how likely a deflationary scenario is. The vast majority of TIPS are aged securities for which accumulated inflation in their nominal principal makes the deflation put far out of the money, and most research on TIPS is based on off-the-run TIPS of this kind. Nonetheless, there is good reason to think that the deflation put was valuable for TIPS issued at the height of the financial crisis in the Fall of 2008.18

A third factor is liquidity. Market participants and financial economists have long argued that the market for TIPS is not as liquid as the market for nominal Treasury bonds, especially in their early years, when arguably inflation-indexed bonds were not as well established and were not as well understood an asset class as they are today, and during the financial crisis of 2008-2009. My research on the role of inflation-indexed bonds in investors' portfolios also suggests TIPS are not likely to be highly liquid securities even in normal times, since they are by design buy-and-hold securities for most investors. Finally, inflation-indexed bonds do not appear to attract the same kind of attention as nominal Treasuries from institutional investors around the globe as a refuge security, building block for derivative securities, and widely accepted collateral in a wide array of financial transactions.

If TIPS are less liquid than Treasury bonds, this liquidity differential might result in a liquidity discount on the prices of TIPS relative to nominal Treasury bonds or, equivalently, a premium on the yield on TIPS. In that case TIPS yields overestimate real interest rates, and breakeven inflation underestimates expected inflation. The question then is whether this discount really exists and if so how large it is in practice, whether it is time varying and whether this variation is correlated with measures of aggregate risk.

I have explored these questions in my research with Carolin Pflueger and found that indeed inflation-indexed bonds trade at a discount relative to nominal Treasury bonds, and that the magnitude of this discount has varied substantially over the history of the TIPS market. Our estimates suggest that it was large — above 100 basis points — during the first few years of the market and at the height of the financial crisis in the Fall of 2008 and the Winter of 2009, and much lower but still substantial — above 25 basis points — at other "normal" times.

Our estimates are based on regressions of breakeven inflation on variables that proxy for inflation expectations and variables that proxy for liquidity, both market-wide liquidity — such as the on-the-run off-the-run spread in the nominal Treasury market—and TIPS market liquidity — such as trading volume on TIPS relative to nominal Treasuries. We find that liquidity proxies explain almost as much variation in breakeven inflation as inflation proxies — and this holds even if we exclude the financial crisis from the sample.19 A measure of historical breakeven inflation adjusted for liquidity in this way suggests that bond market inflation expectations are much more stable and larger on average than raw measures of breakeven inflation imply. In particular, while breakeven inflation experienced a very significant fall in the Fall of 2008, suggesting a scenario of extremely low inflation and even severe deflation over the next several years, liquidity-adjusted inflation suggested a much milder fall in inflation expectations and (or) inflation risk premia. UK inflation-linked gilts also appear to carry a discount relative to UK nominal gilts, although smaller and less variable over time.

Under the assumption that the liquidity differential between inflation-indexed bonds and nominal bonds is all a discount in the price of inflation-indexed bonds, we can measure liquidity-adjusted inflation-indexed bond yields and returns. Using these inflation-adjusted returns, we find that there is still substantial evidence of excess return predictability in liquidity-adjusted inflation-indexed bond returns as well as in breakeven inflation returns in both the US and the UK, which we interpret as evidence of a time-varying real interest risk premium and a time-varying inflation risk premium. We also test whether supply effects of the sort suggested by the preferred habitat theory with limits to arbitrage drive the return predictability on inflation-indexed bonds, but we find no evidence of such effects.

Interestingly, we find that changes in the relative liquidity discount on TIPS are negatively correlated with aggregate stock market returns. Since the liquidity discount on TIPS increases when the market falls, it makes TIPS systematically riskier and thus further lowers their prices relative to those that would prevail if the liquidity discount were constant. That is, the liquidity discount in TIPS prices—or equivalently the liquidity premium on TIPS yields—partly reflects a liquidity risk premium on TIPS, which is also time varying.

If the significant relative liquidity discount is all in the price of TIPS, my research suggests that long-term investors for whom short-term liquidity is not important have historically extracted an additional benefit from holding TIPS in the form of a price discount. This in turn implies that the US Treasury and more generally the sellers of TIPS have "left money on the table," not raising as much revenue as they could have by issuing nominal Treasury bonds. In related research, Matthias Fleckenstein, Francis Longstaff, and Hanno Lustig also show strong evidence that inflation derivatives are subject to severe mispricing, from which the Treasury could benefit by arbitraging the cash and derivatives market for inflation.20

An alternative interpretation is that TIPS are priced according to their fundamentals, but that nominal Treasury bonds carry a price premium investors are willing to pay for holding them. This implies that TIPS holders are not benefiting from a discount, but it still implies that the Treasury could raise more revenue by issuing nominal bonds instead of TIPS. Of course, revenue maximization need not be the only reason for a government to issue bonds. The government can contribute to improve social welfare by completing markets. My research on the key role of TIPS on the portfolios of long-term investors, such as individual investors saving for retirement, shows that issuing TIPS can be welfare enhancing. The shift in the provision of pension benefits in the US from defined benefit to defined contribution suggests that the importance of TIPS for savers has, if anything, increased over time.

* Luis M. Viceira is a Research Associate in the NBER's Program on Asset Pricing and the George E. Bates Professor at the Harvard Business School.

1. J. Y. Campbell and L. M. Viceira, "Who Should Buy Long-Term Bonds?," American Economic Review, Vol. 91, No. 1, March 2001. Also NBER Working Paper 6801.

2. As vividly described in The Wall Street Journal article of July 7, 2003, "As Fed Cuts Rates, Retirees Are Forced To Pinch Pennies — With Interest Income Down, Seniors in Florida Complex Are Facing Tough Choices — A $1.63 Splurge at Burger King."

3. J. Y. Campbell and L. M. Viceira, "Who Should Buy Long-Term Bonds?," American Economic Review, Vol. 91, No. 1, March 2001 (and NBER Working Paper 6801) and J. Wachter, "Risk aversion and allocation to long-term bonds," Journal of Economic Theory 112:325--333, October 2003.

4. L. M. Viceira, "Life-Cycle Funds," Chapter 5 in Overcoming the Saving Slump: How to Increase the Effectiveness of Financial Education and Saving Programs, A. Lusardi, ed., University of Chicago Press, 2008. F. J. Gomes, L. J. Kotlikoff, and L. M. Viceira, "Optimal Life-Cycle Investing with Flexible Labor Supply: A Welfare Analysis of Life-Cycle Funds," American Economic Review: Papers and Proceedings, Vol. 98, pp. 297-303, May 2008. Also NBER Working Paper 13966.

5. J. Y. Campbell and L. M. Viceira, "The Term Structure of the Risk-Return Tradeoff," Financial Analysts Journal, Vol. 61, No. 1, 2005. Also NBER Working Paper 11119.

6. This is an updated version of Figure 1 in J. Y. Campbell and L. M. Viceira, "The Term Structure of the Risk-Return Tradeoff," Financial Analysts Journal, Vol. 61, No. 1, 2005. Also NBER Working Paper 11119.

7. J. Y. Campbell and L. M. Viceira, "Who Should Buy Long-Term Bonds?," American Economic Review, Vol. 91, No. 1, March 2001. Also NBER Working Paper 6801. J.Y. Campbell, R.J. Shiller, and L. M. Viceira, "Understanding Inflation-Indexed Bond Markets," Brookings Papers on Economic Activity 79-120, Spring 2009. Also NBER Working Paper 15014. J.Y. Campbell. A. Sunderam, and L. M. Viceira, "Inflation Bets or Deflation Hedges? The Changing Risks of Nominal Bonds," NBER Working Paper 14701, 2013.

8. This is an updated version of Figure 1 in L. M. Viceira, "Bond Risk, Bond Return Volatility, and the Term Structure of Interest Rates," International Journal of Forecasting, Volume 28, pp. 97-117, 2012. See also J.Y. Campbell. A. Sunderam, and L. M. Viceira, "Inflation Bets or Deflation Hedges? The Changing Risks of Nominal Bonds," NBER Working Paper No. 14701, 2013.

9. J. Y. Campbell, R. J. Shiller, and L. M. Viceira, "Understanding Inflation-Indexed Bond Markets," Brookings Papers on Economic Activity 79-120, Spring 2009. Also NBER Working Paper 15014.

10. See Figure 7 in J. Y. Campbell. A. Sunderam, and L. M. Viceira, "Inflation Bets or Deflation Hedges? The Changing Risks of Nominal Bonds," NBER Working Paper 14701, 2013.

11. See Figure 7 in J. Y. Campbell, R. J. Shiller, and L. M. Viceira, "Understanding Inflation-Indexed Bond Markets," Brookings Papers on Economic Activity 79-120, Spring 2009. Also NBER Working Paper 15014.

12. J. Y. Campbell and J. Cochrane, "By force of habit: a consumption-based explanation of aggregate stock market behavior." Journal of Political Economy 107, 205–251, 1999. (Also NBER Working Paper 4995) and J. A. Wachter, "A consumption-based model of the term structure of interest rates," Journal of Financial Economics 79:365-399, February 2006.

13. J. Y. Campbell, A. Sunderam, and L. M. Viceira, "Inflation Bets or Deflation Hedges? The Changing Risks of Nominal Bonds," NBER Working Paper 14701, 2013.

14. J. Cochrane and M. Piazzesi, "Bond risk premia," American Economic Review 95, 138–160, 2005. Also NBER Working Paper 9178.

15. J. Y. Campbell and R. J. Shiller, "Yield Spreads and Interest Rate Movements: A Bird's Eye View." Review of Economic Studies 58, 495—514, 1991. See also NBER Working Paper 3153. J. Cochrane and M. Piazzesi, "Bond risk premia," American Economic Review 95, 138–160, 2005. Also NBER Working Paper 9178.

16. J. A. Wachter, "A consumption-based model of the term structure of interest rates," Journal of Financial Economics 79:365-399, February 2006. R. Bansal and I. Shaliastovich, "A Long-Run Risks Explanation of Predictability Puzzles in Bond and Currency Markets," Review of Financial Studies 26(1), 1-33, 2013. Also NBER Working Paper 18357.

17. C. E. Pflueger and L. M. Viceira, "Inflation-Indexed Bonds and the Expectations Hypothesis," Annual Review of Financial Economics, Vol. 3: 139-158, December 2011. Also NBER Working Paper 16903. C. E. Pflueger and L. M. Viceira, "Return Predictability in the Treasury Market: Real Rates, Inflation, and Liquidity," manuscript, Harvard University, April 2013. Also NBER Working Paper 16892.

18. J. Y. Campbell, R. J. Shiller, and L. M. Viceira, "Understanding Inflation-Indexed Bond Markets," Brookings Papers on Economic Activity 79-120, Spring 2009. Also NBER Working Paper 15014. J. H. Wright, "Comment on Understanding Inflation-Indexed Bond Markets," Brookings Papers on Economic Activity, Spring 2009.

19. C. E. Pflueger and L. M. Viceira, "Return Predictability in the Treasury Market: Real Rates, Inflation, and Liquidity," manuscript, Harvard University, April 2013. Also NBER Working Paper 16892. D'Amico, Stefania, Don H. Kim, and Min Wei, "Tips from TIPS: the informational content of Treasury Inflation-Protected Security prices," staff working paper, Federal Reserve Board, Finance and Economics Discussion Series, 2010. J. H. Wright, R. S. Gürkaynak, and B. Sack, "The TIPS yield curve and Inflation Compensation," American Economics Journal: Macroeconomics, vol. 2, pp.70-92, 2010.

20. M. Fleckenstein, F. A. Longstaff, and H. Lustig, 2010, "Why does the Treasury Issue TIPS? The TIPS-Treasury Bond Puzzle," forthcoming Journal of Finance. Also NBER Working Paper 16358.