NBER Reporter 2011 Number 1: Research Summary

Reducing the Risks of Catastrophes

Howard Kunreuther*

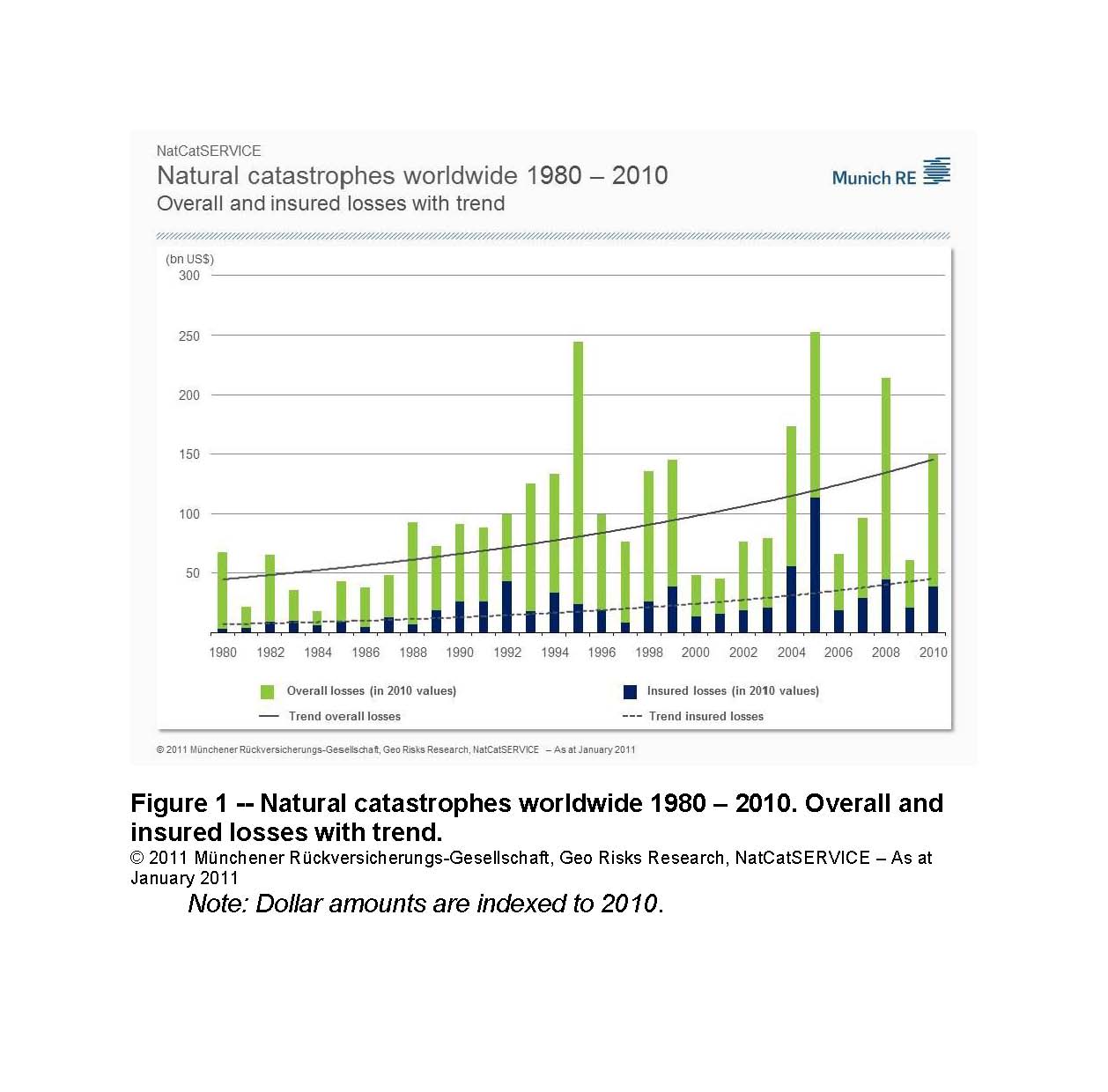

Given the hundreds of billions of dollars in economic losses that catastrophes have caused in the United States since 2001, people often are surprised to learn that Hurricane Hugo, which struck the South Carolina coast in 1989, was the first disaster to inflict more than $1 billion of insured losses. Sixteen years later, Hurricane Katrina cost insurers and reinsurers an estimated $48 billion.1

A comparison of economic losses from natural catastrophes alone reveals a large increase over time: $528.3 billion (1981-1990); $1,196.8 billion (1991-2000); and $1,213.5 billion (2001-2010).

( pdf )

There have been many types of extreme events in recent years (for example, the 9/11 terrorist attacks, natural disasters such as Hurricane Katrina, technological accidents such as the BP oil spill, and the financial crisis of 2008), but they all have the following features in common:

- A failure of key decision makers to undertake risk reducing measures in advance of the disaster;

- A lack of availability of insurance to cover some potential catastrophic losses (such as from terrorism). When insurance is available, it generally does not provide financial incentives to encourage investment in risk reducing measures;

- Growing interdependencies and interconnectedness in the world, and our inability to appreciate how weak links can cause systemic failures.

Over the past ten years, much of my research, in collaboration with colleagues, seeks to explain these issues and considers ways to mitigate the losses from future catastrophes.

Failure of individuals to undertake protective measures

There are two types of measures that those at risk can undertake to reduce the financial consequences of low probability adverse events: investing in loss reduction measures and purchasing insurance. However, there is a key difference between these two protective actions. Insurance normally is purchased on an annual basis with an option to renew for the coming year. Investing in loss-reduction measures involves an upfront cost, such as the outlay to install shutters to prevent losses from hurricanes; the benefits normally accrue over the life of the structure.

Prior to a disaster, many individuals believe that the event is below their threshold level of concern and thus do not invest voluntarily in insurance and protective measures.2 After a major flood, earthquake, or hurricane, the government may provide at least some financial assistance to aid the recovery of the unprotected victims. Hurricane Katrina provided vivid evidence of this. Many homeowners who suffered water damage from the disaster did not have flood insurance, even though they were eligible to purchase such a policy at a subsidized rate through the National Flood Insurance Program (NFIP). In the Louisiana parishes affected by Katrina, the percentage of homeowners with flood insurance ranged from 57.7 percent in St. Bernard's to 7.3 percent in Tangipahoa. Only 40 percent of the residents in Orleans parish had flood insurance.3

Furthermore, homeowners are likely to cancel their flood insurance policies, even if they had been required to purchase a policy as a condition for a federally insured mortgage. A large-scale analysis of the 7.9 million new policies issued by the NFIP over the period January 1, 2000-December 31, 2009 revealed that the median length of time before those flood policies lapse is only three years. 4

Most individuals are reluctant to invest in protective measures, even if they recognize the likelihood of a disaster. They are highly myopic and tend to focus on the returns only over the next couple of years. The effect of placing too much weight on immediate considerations is that the upfront costs of mitigation will loom disproportionately large relative to the delayed expected benefits in losses over time.5

A 1974 survey of more than 1,000 California homeowners in earthquake-prone areas revealed that only 12 percent of the respondents had adopted any protective measures.6 Fifteen years later, there was little change, despite the increased public awareness of the earthquake hazard. In a 1989 survey of 3,500 homeowners in four California counties at risk from earthquakes, only 5 to 9 percent of the respondents in these areas reported adopting any loss reduction measures.7 Other studies have found a similar reluctance by residents in flood-prone areas to invest in mitigation measures. 8

As a way of characterizing behavior that deviates from standard models of choice, such as expected utility theory, David Krantz and I propose a model of goals and plans that is based on a constructive model of choice. More specifically, the weights associated with different goals may change over time as a function of resources, past information, and social norms. 9 We apply this model to protective decisions in an attempt to explain anomalies, such as people insuring against non-catastrophic events, underinsuring against catastrophic risks, and allowing such factors as anxiety and peace of mind to influence their insurance purchases and other protective actions. Neither expected utility theory nor prospect theory can explain these anomalies satisfactorily.

Insurers' reluctance to provide protection against catastrophic risks

Insurers exhibit biases similar to those of consumers. The case of terrorism coverage illustrates this point rather dramatically. Even after the terrorist attack on the World Trade Center in 1993 and the Oklahoma City bombing in 1995, insurers in the United States did not view either international or domestic terrorism as a risk that should be explicitly considered when pricing their commercial insurance policies.

Following the terrorist attacks of 9/11, insurers found themselves with significant amounts of terrorism exposure in their existing portfolios and only limited possibilities of obtaining reinsurance to reduce the losses from a future attack. Insurers warned that another event of comparable magnitude could do irreparable damage to the industry, and most companies excluded terrorism protection from their commercial policies, with the remaining insurers charging extremely high premiums for coverage. This led Congress to pass the Terrorism Risk Insurance Act of 2002, which involved risk sharing between the insurance industry and federal government. 10

Similar withdrawal of insurance coverage occurred after the Florida hurricanes of 2005 when the state of Florida refused to provide the rate increases demanded by insurers. Instead, Florida established a state insurer, Citizens Property Insurance Corporations. Citizens' rates were highly subsidized for those residing in hurricane prone areas, which led several insurers to refuse to offer new coverage in the state.11

Interdependencies and weak links in the system

After the terrorist bombing of the World Trade Center on 9/11, Geoffrey Heal and I began exploring the impact that weak links in an interconnected system would have on the decisions of others to invest in protective measures. We focused on the tragic Pan Am 103 crash over Lockerbie, Scotland, in 1988. In that instance, the weak link was an obscure airport, Gozo in Malta, where terrorists checked a bomb on Malta Airlines that eventually was loaded onto Pan Am 103 at London's Heathrow Airport. Pan Am could not have prevented the crash without inspecting every item transferred from other airlines.

Based on a game-theoretic analysis, we show that the incentive of any agent to invest in risk-reduction measures depends on how he expects others to behave in this respect. If he thinks that they will not invest in security, then his incentive to do so is reduced. On the other hand, should he believe that they will invest in security, it might be best for him to do so as well. Thus there may be an equilibrium in which no one invests in protection, even though all would be better off if they had incurred this cost. This situation, which we termed interdependent security (IDS), does not have the structure of a prisoners' dilemma game, even though it has some similarities.12

Alex Muermann and I apply the IDS model to the case where insured individuals face negative externalities in the form of potential contamination. We show that individuals will want to under invest in mitigation measures to reduce their future losses. Limiting insurance coverage through deductibles, or selling "at-fault" insurance, can partially internalize this negative externality and thus improve individual and social welfare.13

At a more general level, a central problem in today's networked world is that the risks a firm or individual faces partially depend on the actions of others. Put more starkly: we no longer control our own destinies, even when we undertake protective measures. Consider the following examples:

- The August 2003 blackout over the northeastern United States and southeastern Canada was caused by an Ohio utility whose inability to provide electricity was passed on to other utilities and customers through an interconnected grid.14

- Actions of even a small division in a giant corporation can cause the entire firm to go under and may have significant effects on the global financial system. One only has to look at the failure of Baring's Bank in February 1995, driven by the actions of a single trader in its Singapore branch, or the demise of Arthur Andersen in 2002 attributable to criminal action by its Houston branch auditing Enron.15

- With respect to the financial crisis of 2008, the American International Group (A.I.G.), the world's largest insurer, suffered severe financial losses because of the actions of a 377-person London unit known as A.I.G. Financial Products, run with almost complete autonomy from the parent. That one unit decimated the entire company. 16

On a more positive note, Heal and I show that if agents are heterogeneous with respect to costs or the degree they impact others, then under relatively weak assumptions there is a tipping set -- a group of agents who can tip the equilibrium from one where no one joins to one where everyone does. To make this idea more concrete, suppose there are 50 agents. Initially they are at an equilibrium at which none of them invests in risk reducing measures. If agents 1 through 5 form a tipping set, that is if they change from not investing in protection to investing, then all others will follow suit; the best strategy for agents 6 through 50, conditional on 1 through 5 investing in risk reducing measures, is for them to also join.17

Multi-year, risk-based contracts with short-term incentives

One way of addressing many of the problems described above is for insurance policies to encourage adoption of risk-reducing measures against catastrophic risks. 18 Insurance premiums based on risk provide signals to individuals about the hazards they face, and encourage them to engage in cost-effective mitigation measures that reduce their vulnerability to catastrophes. This principle is necessary for a competitive insurance market to operate efficiently. Dwight Jaffee, Erwann Michel Kerjan, and I further show the conditions under which multi-year insurance contracts may be superior to standard annual policies, in particular when there is a cost that consumers will have to pay if they decide to cancel their policy and switch to an annual contract.19 Michel-Kerjan and I have studied the impact of attaching multi-year flood insurance contracts to the property, not to the owner, with premiums reflecting risk. Multi-year contracts coupled with short-term incentives and well-enforced regulations comprise one strategy for dealing with the problems of myopia that characterize behavior with respect to low probability/ high consequence. 20

* Kunreuther is Co-Director of the NBER's Working Group on Insurance and a Professor at the Wharton School.

1. For more details on the increased losses from catastrophes, see H. Kunreuther and E. Michel-Kerjan, At War with the Weather, Cambridge, MA: MIT Press, 2009.

2. H. Kunreuther and M. Pauly, "Neglecting Disaster: Why Don't People Insure Against Large Losses?" Journal of Risk and Uncertainty 28 (2004), pp. 5-21.

3. H. Kunreuther and M. Pauly, "Rules rather than Discretion: Lessons from Hurricane Katrina" NBER Working Paper No. 12503, August 2006, and Journal of Risk and Uncertainty, Vol. 33, Numbers 1-2, September 2006, pp. 101-16.

4. E. Michel Kerjan, S. Lemoyne de Forges, and H. Kunreuther, "Policy Tenure under the U.S. National Flood Insurance Program (NFIP)" Wharton Risk Management and Decision Processes Center, (mimeo), 2010.

5. H. Kunreuther, R. J. Meyer, and E. Michel-Kerjan, "Strategies for Better Protection against Catastrophic Risks", forthcoming in Behavioral Foundations of Policy, E. Shafir, ed., Princeton, NJ: Princeton University Press.

6. H. Kunreuther, R. Ginsberg, L. Miller, P. Sagi, P. Slovic, B. Borkan, and N. Katz, Disaster Insurance Protection: Public Policy Lessons, New York: John Wiley and Sons, 1978.

7. R. Palm, M. Hodgson, R. D. Blanchard, and D. Lyons, Earthquake Insurance in California: Environmental Policy and Individual Decision Making, Boulder, CO: Westview Press, 1990.

8. R. Burby, "Hurricane Katrina and the Paradoxes of Government Disaster Policy: Bringing about Wise Governmental Decisions for Hazardous Areas," Annals of the American Academy of Political and Social Science 604, 2006, pp.171-91; S.B. Laska, Floodproof Retrofitting: Homeowner Self-Protective Behavior, Boulder, CO: Institute of Behavioral Science, University of Colorado, 1991.

9. D. Krantz and H. Kunreuther, "Goals and Plans in Protective Decision Making," NBER Working Paper No. 12446, August 2006, and Judgment and Decision Making, Vol. 2, No. 3, June 2007, pp. 137-168.

10. H. Kunreuther and E. Michel-Kerjan, "Policy Watch: Terrorism Risk Insurance in the United States," NBER Working Paper No. 10870, November 2004, and Journal of Economics Perspectives, 18 (4), 2004, pp. 201-14.

11. At War with the Weather, op. cit.

12. H. Kunreuther and G. Heal, "Interdependent Security," NBER Working Paper No. 8871, April 2002, and Journal of Risk and Uncertainty, Springer, 26(2-3), 2003, pp. 231-49

13. A. Muermann and H. Kunreuther, "Self-Protection and Insurance with Interdependencies," NBER Working Paper No. 12827, January 2007, and Journal of Risk and Uncertainty, 36, 2008, pp. 103-23.

14. G. Heal and H. Kunreuther, "Interdependent Security: A General Model", NBER Working Paper No. 10706, August 2004, and "Modelling Interdependent Risks", Risk Analysis, 27, 2007, pp. 621-34.

15. G. Heal and H. Kunreuther, "You Only Die Once: Managing Discrete Interdependent Risks", NBER Working Paper No. 9885, August 2003, and "You Only Die Once: Interdependent Security in an Uncertain World", in The Economic Impacts of Terrorist Attacks, H.W. Richardson, P. Gordon, and J.E. Moore II, eds., Cheltenham, UK: Edward Elgar, 2005.

16. H. Kunreuther, "The Weakest Link: Managing Risk Through Interdependent Strategies", in Network Challenge: Strategy, Profit and Risk in an Interlinked World, P. R. Kleindorfer and Y. Wind, eds., Upper Saddle River, NJ: Wharton School Publishing, 2009.

17. G. Heal and H. Kunreuther, "Supermodality and Tipping," NBER Working Paper No. 12281, June 2006, and "Social Reinforcement: Cascades, Entrapment and Tipping," NBER Working Paper No. 13579, November 2007, and American Economic Journal: Microeconomics, 2(1), 2010, pp.86-99.

18. At War with the Weather, op. cit.

19. D. Jaffee, H. Kunreuther, and E. Michel-Kerjan, "Long-Term insurance (LTI) for Addressing Catastrophic Market Failure," NBER Working Paper No. 14210, August 2008, and Journal of Insurance Regulation, 2010 Issue, (29)7, pp. 167-187.

20. H. Kunreuther and E.O. Michel-Kerjan, "Market and Government Failure in Insuring and Mitigating Natural Catastrophes: How Long-Term Contracts Can Help" in Public Insurance and Private Markets, J. R, Brown, ed., Washington, DC: AEI Press, 2010.