NBER Reporter 2010 Number 2: Research Summary

Bubbles, Liquidity, and the Macroeconomy

Markus K. Brunnermeier*

The recent financial crisis has shown that financial frictions, such as asset bubbles and liquidity spirals, have important consequences, not only for the financial sector but also more generally for the macroeconomy. This forces economists to reevaluate firmly held beliefs about market efficiency, the appropriate regulation of financial markets, and approaches to macroeconomic policymaking. The subsequent paragraphs summarize my ongoing research in these domains.

Asset Price Bubbles

Under the efficient market hypothesis, bubbles burst before they even have a chance to emerge. Hence, an assets market price should correctly reflect its underlying fundamental value. However, bubbles historically have emerged as investors were willing to hold assets, even when their prices exceeded their fundamental value -- they hoped to sell these assets at an even higher price to some other investor in the future. In a setting in which a single investor alone cannot bring down a bubble, it can be rational for an individual to ride the bubble. In other words, the uncertainty of not knowing when other investors will start trading against the bubble makes each individual rational investor anxious about whether he can afford to be out of (or short) the market until the bubble finally bursts. Consequently, each investor is reluctant to lean against the bubble and might even prefer to ride it. Thus price corrections only occur with delay, and often abruptly.1 My empirical research with Stefan Nagel studies hedge funds holdings of technology stocks during the internet bubble, and it confirms that even sophisticated investors were riding the bubble rather than leaning against it.

The second important message of this line of research is that small, fundamentally unimportant news can trigger large price swings. Such information can serve as a synchronization device that triggers the attack on a bubble. This explains why most large asset price movements are not associated with important news announcements.2 It also suggests that communication by central bankers and regulators is a very important policy tool.

The bubble-riding hypothesis also provides a different view of risk measures. Even though risk seems to be tamed while the bubble is inflating, risk and imbalances are building up below the surface, and volatility suddenly spikes when the bubble bursts. This is in contrast to the efficient market view, which asserts that contemporaneous risk measures appropriately capture current risk exposure.

Credit Bubbles and Liquidity Spirals

One important lesson from the current crisis is that credit bubbles, like the recent housing bubble or the stock market bubble in the 1920s, can be much more detrimental than the bubbles that are not financed with debt, such as the internet bubble. The reason is that during the bursting of a credit bubble, amplification effects exacerbate initial shocks and impair the financial system.

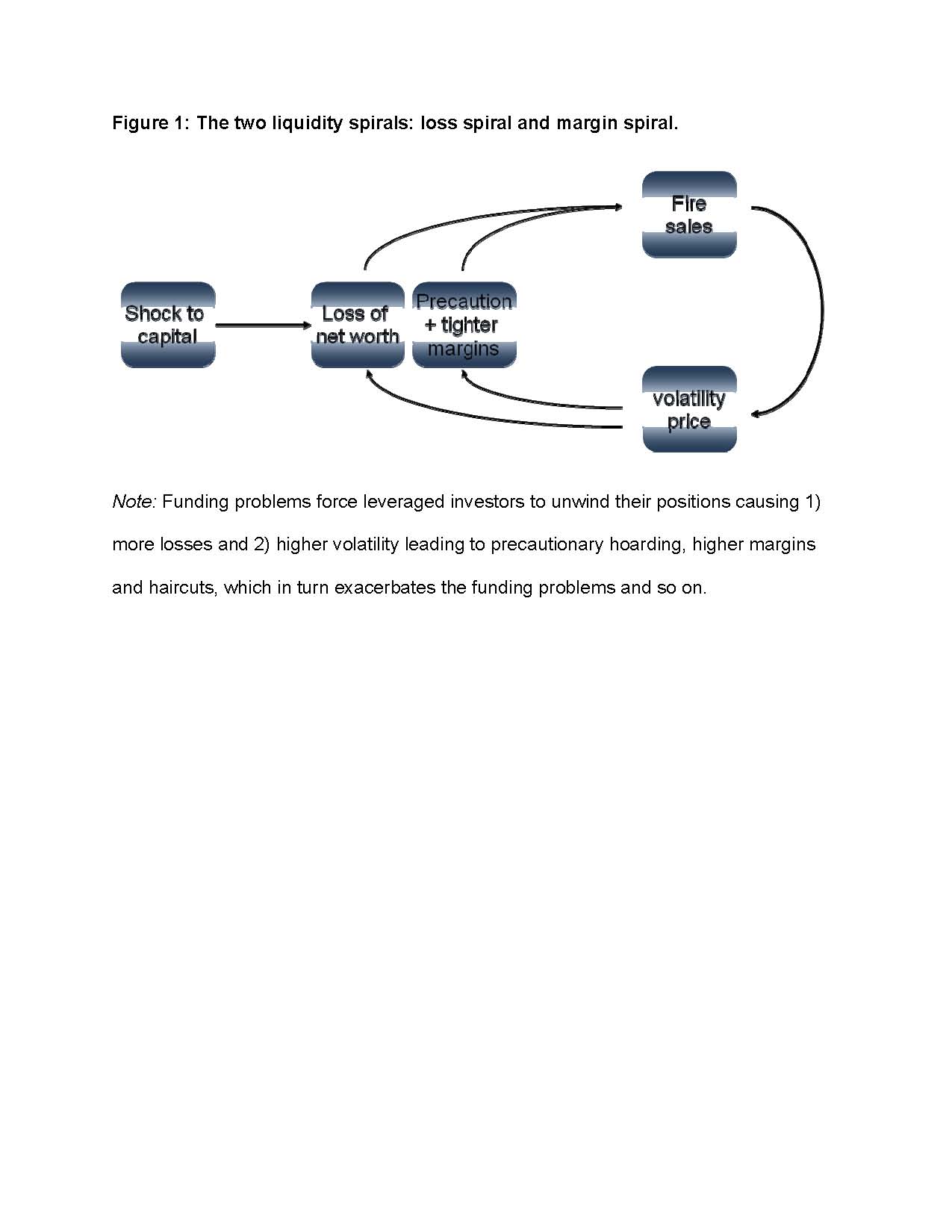

My paper Deciphering the Liquidity and Credit Crunch3 describes the transformation of the banking system to one that increasingly relied on wholesale funding and the emergence of the "shadow banking system." What made the shadow banking especially unstable was that it excessively relied on short-term financing. As a result, a large fraction of credit had to be rolled over each day. Note that collateral loans, which are subject to daily increases in margins or haircuts, are essentially only overnight loans. The amplification effects can be described by two liquidity spirals: the loss spiral (outer spiral) and the margin/haircut spiral (inner spiral shown in Figure 1 below).

The loss spiral arises for leveraged investors. A decline in assets' values erodes these investors' net worth much faster than their gross worth (because of their leverage), and the amount that they can borrow consequently falls, which forces further liquidation. This in turn leads to further price drops. For example, consider an investor who buys $100 million worth of assets on 10 percent margin. This investor finances only $10 million with his own capital and borrows $90 million. The leverage ratio is therefore 10. Now suppose that the value of the acquired asset declines temporarily to $95 million. The investor, who started out with $10 million in capital, has lost $5 million and has only $5 million of his own capital remaining. Holding the leverage ratio constant at 10, this investor is forced to reduce the overall position to $50 millionwhich means selling assets worth $45 million exactly when the price is low. These sales depress the price further, inducing more selling and so on.

Figure 1

Figure 1

The margin/haircut spiral reinforces the loss spiral. Margins and haircuts spike in times of large price drops, leading to a general tightening of lending. As margins or haircuts rise, the investor has to sell even more than he would have because of the loss spiral alone, because he needs to reduce his leverage ratio (which was held constant in the loss spiral). Pedersen and I (2009) 4 show that a vicious cycle emerges, whereby higher margins and haircuts force de-leveraging and more sales, which increase margins further and force more sales, leading to the possibility of multiple equilibriums. In addition, borrowers demand decreases: because of higher volatility, they are afraid that they will not be able to roll over their debt in the future and will be forced to sell their assets exactly when the price level (market liquidity) is depressed. They are therefore less willing to hold risky assets in the first place.

On the Macroeconomy

More generally, while the financial system makes the economy more efficient, it also can be the reason for macroeconomic instability. My recent work with Yuliy Sannikov incorporates these financial frictions into macroeconomic models. In this line of research, productive agents borrow from less productive households, partially through intermediaries such as banks. We show that the economy is prone to instability and occasionally enters volatile episodes. While in existing models like Bernanke-Gertler-Gilchrist (1998)5 and Kiyotaki-Moore (1995)6, financial frictions amplify the initial shock and lead to persistent reduced economic activity, we identify a channel that emphasizes the importance of the precautionary motive by investors. This channel significantly dampens prices and economic activity. Interestingly, the stationary distribution of the dynamic system in our model is bimodal, implying that (without government intervention) the dynamic system can be stuck in the crisis state for a significant amount of time. Log-linear approximations that are popular in much of the existing macroeconomic literature fail to capture these important non-linear effects.

Most importantly from a policy perspective, we show that financial experts impose a negative externality on each other and on the labor sector by not maintaining adequate capital cushions and a sustainable funding structure. These externalities are a major source of market failure. The problem is that although it can be socially costly, it can be individually optimal to expose oneself to the risk of getting caught in a liquidity spiral by holding highly leveraged positions with a mismatch in asset-liability maturities. Each individual speculator takes future prices as given and hence does not take into account the fact that unloading assets will cause some adverse effects on other speculators, forcing them to sell their positions as well. My work with Yuliy Sannikov also shows that the financial sector does not fully internalize the externalities it causes on the labor market because workers prefer a more conservative bonus-and-dividend policy than financial experts.

Systemic Risk Measure CoVaR Financial Stability

My paper CoVaR,7 written with Tobias Adrian, attempts to measure the spillover effects that the failure of one financial institution has on the aggregate system. We propose a dramatic shift away from measuring the risk of a financial institution in isolation (like the Value-at-Risk does) towards macro-prudential measures of systemic risk. Our approach recognizes that splitting one large, individually systemic institution into many small identical clones does not increase financial stability, because all the clones co-move perfectly with each other and thus are systemic as part of a herd. Therefore, simply regulating financial institutions based on their size ultimately cannot reduce the risk of a financial crisis. Rather, regulatory regimes must be designed to recognize that the financial system is heterogeneous. It is well known in systems and complexity theory that systems of heterogeneous entities are much more stable than homogenous systems.

The second challenge is that financial regulation, which is directly based on risk measures, introduces an element of pro-cyclicality, even if it is based on systemic risk measures. Any risk measure declines during a boom, even though risk is building up in the background, only to materialize when an adverse shock hits. Immediately following the first shock, risk measures shoot up and cause financial regulation to tighten just when it should be loosened. Hence, it is important for regulatory policy to take into account variables and characteristics of financial institutions that are both easily observable and forecast future spillover effects. The CoVaR approach provides one method for identifying these characteristics and determining how much weight should be assigned to each of them. Relying on data that encapsulates the major crises of the last 23 years, the CoVaR method calibrates the relative importance of various characteristics. For example, our estimates show that financial institutions spillover risk increases more than proportionally with its size and gives precise estimates of the reduction of leverage that is needed in order to offset increased maturity mismatch.

Price and Financial Stability

Recent events have highlighted the close connection between (non-conventional) monetary policy and financial stability -- the two cannot be divorced. My most recent work with Yuliy Sannikov shows how an ailing financial system can lead to deflationary pressure. In our model, agents are subject to productivity shocks. Consequently, some agents are productive while others are not. If there were no money, even the unproductive agents would accumulate physical capital, wanting to hold capital when they face a positive productivity shock. Introducing (fiat) money leads to large efficiency gains, because unproductive agents can then sell their physical capital for money. Hence, physical capital is held only by productive agents, while less productive agents hold money. However, productive agents borrowing and leverage is limited because private lenders have only limited monitoring technology. In contrast, banks are better at monitoring borrowers. Therefore, they extend bigger loans. By issuing short-term debt, banks create (inside) money. Overall, this leads to higher leverage and further enhances productivity in the economy. However, banks monitoring activity depends on how well they are capitalized. After a negative shock, they cut back on their lending activities for precautionary hoarding reasons. As a consequence, their (inside) money creation shrinks. Consequently, the value of (outside) money rises, causing deflationary pressure, which can be mitigated either by a redistribution of resources towards banks or by expanding the outside money supply. Overall, our model strives to provide an integrated framework for studying the simultaneous regulation of the financial sector and monetary policy. Importantly, money arises endogenously in our setting, and since financing frictions are the driving force in our model, we do not need to rely on price rigidity to derive our results.

* Brunnermeier is a Research Associate in the NBER's Program Asset Pricing and the Edwards S. Sanford Professor of Economics at Princeton University. His Profile appears later in this issue.

1. D. Abreu and M. K. Brunnermeier, "Bubbles and Crashes," Econometrica, 2003.

2. See for example D. M. Cutler, J.M. Poterba, and L. H. Summers, "What Moves Stock Prices?" NBER Working Paper No. 2538, July 1989, and The Journal of Portfolio Management, Vol. 15, No. 3, pp. 4-12, Spring 1989.

3. M. K. Brunnermeier, "Deciphering the Liquidity and Credit Crunch 2007-08," NBER Working Paper No. 14612, December 2008, and Journal of Economic Perspectives, American Economic Association, Vol. 23(1), pp. 77-100, Winter 2009.

4. M. K. Brunnermeier and L. H. Pedersen, "Market Liquidity and Funding Liquidity," NBER Working Paper No. 12939, February 2007, and Review of Financial Studies, Oxford University Press for Society for Financial Studies, Vol. 22(6), pp. 2201-38, June 2009.

5. B. Bernanke, M. Gertler, and S. Gilchrist, "The Financial Accelerator in a Quantitative Business Cycle Framework," NBER Working Paper No. 6455, March 1998, in Handbook of Macroeconomics, Edition 1, Volume 1, J. B. Taylor & M. Woodford

6. N. Kiyotaki and J. Moore, "Credit Cycles," NBER Working Paper No. 5083, April 1995, and Journal of Political Economy, v 105, 2, (April 1997) pp. 211-48.

7. T. Adrian and M. K. Brunnermeier, "CoVaR," working paper, Federal Reserve Bank of New York, 2008.