NBER Reporter: Research Summary 2008 Number 4

Bossonomics? The Economics Of Management And Productivity

Nick Bloom and John Van Reenen*

Management and Productivity

Economists have long speculated on why such astounding differences in productivity exist between firms and plants within countries, even within the same narrow sector.1 While the popular press and business schools have long stressed the importance of different management practices, empirical economists have had relatively little to say about management. 2 A major problem has been the absence of high quality management data that is measured in a consistent way across firms and countries.

Despite this data constraint, heterogeneity in managerial and entrepreneurial ability has become the foundation for a wide range of literatures.3 In many benchmark theories, it is assumed that management is an unobservable factor that varies across firms, driving productivity differences. In parallel, Mundlak labelled his fixed-effect differences in productivity as "unobserved managerial ability."4

Measuring Management using Double-Blind Surveys

To address this lack of management data, we have been developing a methodology for measuring management practices.5 We use an interview-based evaluation tool that defines and scores from one ("worst practice") to five ("best practice") 18 basic management practices. This evaluation tool was developed by an international consulting firm, and scores these practices in three broad areas:

To obtain accurate responses from firms, we interview production plant managers using a "double-blind" technique: managers are not told they are being scored or shown the scoring grid; they are only told they are being "interviewed about management practices for a research project." To run this blind scoring, we use open questions. For example, on the first monitoring question, we ask "tell me how you monitor your production process," rather than asking a closed question such as "do you monitor your production daily [yes/no]". We continue with open questions targeting actual practices and examples until the interviewer can make an accurate assessment of the firm's practices. For example, the second question on that performance tracking dimension is "what kinds of measures would you use to track performance?". The scoring grid for this performance tracking dimension is shown here as an example.

The other side of the double-blind technique is that interviewers are not told in advance anything about the firm's performance. They are only provided with the company name, telephone number, and industry. Since we randomly sample medium-sized manufacturers (employing between 100 to 10,000 workers) who are not usually reported in the business press, the interviewers generally have not heard of these firms before, so have no preconceptions.

To ensure high sample response rates and skilled interviewers, we hired MBA students to run interviews. We also obtained government endorsements for the surveys in each country covered, and positioned it as a "Lean manufacturing" interview with no requests for financial data. These steps helped to yield a 45 percent response rate which was uncorrelated with the (independently collected) performance measures.

|

Management

Practice Dimension 4 (Performance tracking) |

|||

|

|

Score 1 |

Score 3 |

Score 5 |

|

Scoring grid |

Measures tracked do not

indicate directly if overall business objectives are being met. Tracking is

an ad-hoc process (certain processes arent tracked at all). |

Most key

performance indicators are tracked formally. Tracking is overseen by senior

management. |

Performance is continuously

tracked and communicated, both formally and informally, to all staff using a

range of visual management tools. |

|

Example firm |

A manager

tracks a range of measures when he does not think that output is sufficient.

He last requested these reports about 8 months ago and had them printed for a

week until output increased again. Then he stopped and has not requested

anything since. |

At a firm

every product is bar-coded and performance indicators are tracked throughout

the production process. However, this information is not communicated to

workers |

A firm has

screens in view of every line, to display progress to daily target and other

performance indicators. The manager meets daily with the shop floor to

discuss performance metrics, and monthly to present a larger view of the

company goals and direction. He even stamps canteen napkins with performance

achievements. |

Management Practices across Firms and Countries

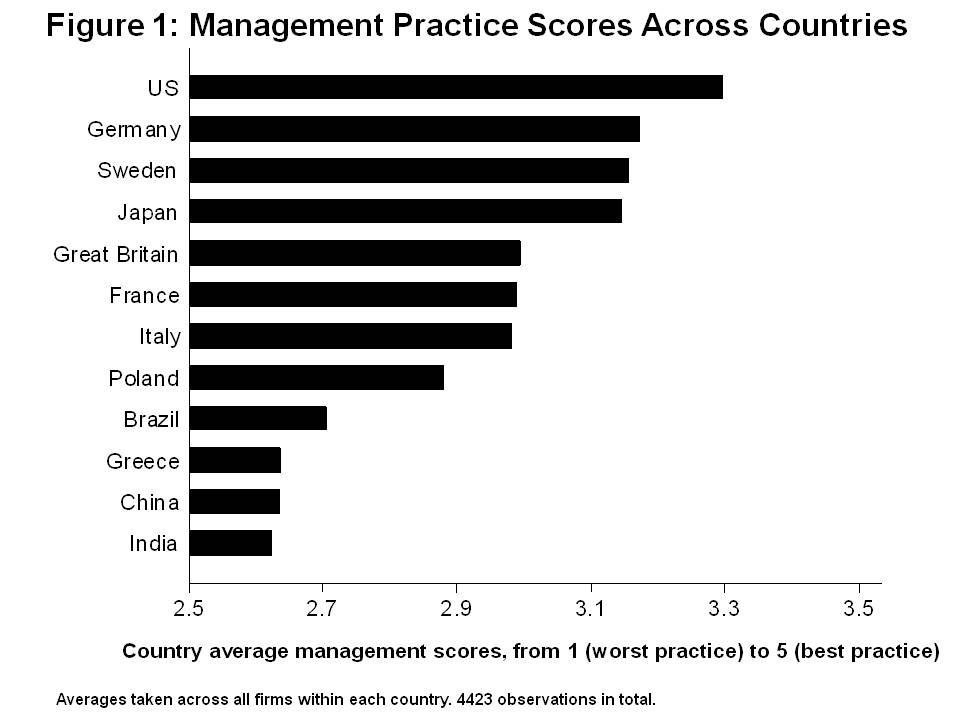

The bar chart in Figure 1 plots the average management practice score across countries from the 6,000 interviews we carried out in survey waves from 2004 to 2008. This shows the United States has the highest management practice scores on average 6, with the Germans, Japanese, and Swedes next, followed by a block of mid-European countries (France, Italy, the United Kingdom, and Poland), with Southern Europe and developing countries Brazil, China, Greece, and India at the bottom. In one sense this is not surprising because it approximates the cross-country spread of productivity. But in another sense it suggests management practices could play an important role in determining country-level productivity. At the firm-level, better management practices are strongly associated with higher firm-level productivity, profitability, and survival 7, suggesting they could play an equally important role in country-level productivity. Better management is also linked with improved employee work-life-balance and lower energy use, suggesting better management does not come at the expense of worker welfare or more pollution.8

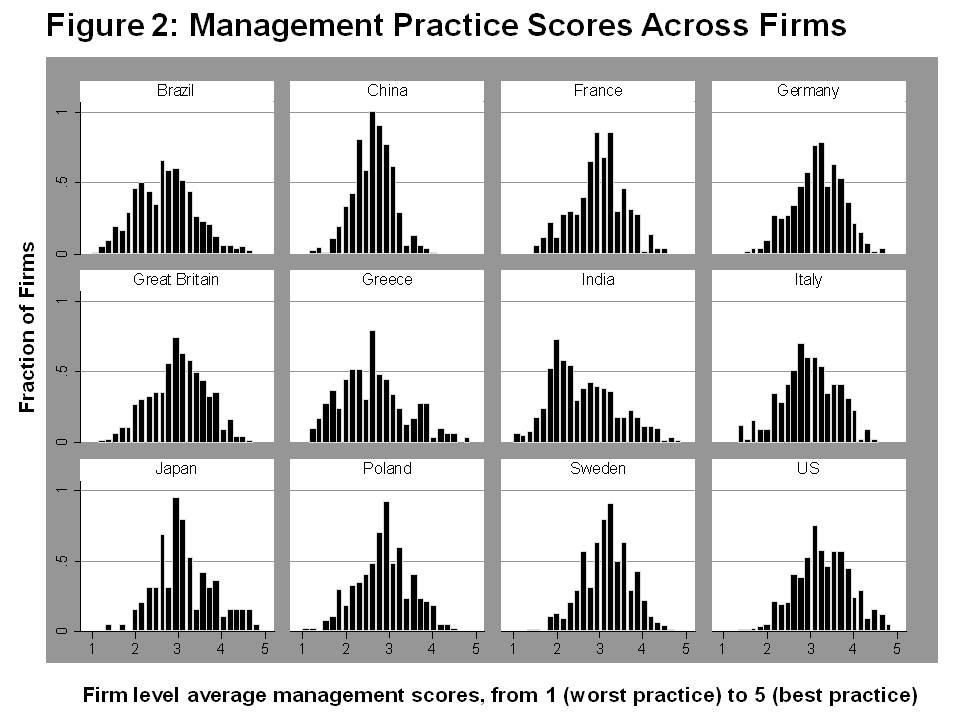

Of course the key question is why are management practices different across countries? Figure 2 plots the firm-level histogram of management practices by country, and shows that management practices display tremendous within-country variation. So, much like productivity figures, within-country variation is far greater than cross-country variation. This figure also highlights that U.S. firms have the highest average management score because they have almost no density of firms with management practices below two. Thus, the infamously badly managed paper-supply firm "Dunder-Mifflin" from the TV show "The Office" is thankfully a rare U.S. exception.9 In comparison India, which has the lowest cross-country management score, has a large mass of firms with extremely poor management practices (scores of two or less).

This raises two key questions which we are currently working on: Why do these variations in management practices exist, and to what extent do variations in management practices cause variations in productivity?

Why do management practices vary so much across firms and countries?

We have identified three key factors that appear to play an important role in shaping management practices - competition, family ownership, and multinational status.

Product market competition is associated with significantly better management practices. In particular, the tail of badly managed firms shrinks in highly competitive markets. Thus, the competitive product markets of the United States explain much of its lack of badly managed firms. In contrast, many product markets in India have limited competition because of entry barriers, trade regulations, and high transportation costs, enabling badly managed firms to persist.

We are currently investigating the mechanisms through which competition works to improve management. One possibility is Darwinian selection - high levels of competition should drive badly managed firms out of business more quickly. Another is by inducing higher levels of effort - tough product market competition may lead managers to work harder as the stakes are higher (slacking is more likely to lead to losses of market share and bankruptcy). As we follow up the initial cross-sectional firm surveys to convert this into panel data, we can investigate these different mechanisms.

Firms that are both family owned and family managed tend to be badly run on average.10 This is true even after including a battery of econometric controls for country, industry, firm size, human and physical capital intensity. Looking at these family firms in more detail, it appears the worse managed firms are those in particular that hand down the position of CEO using the ancient practice of primogeniture (succession of the eldest son). To elicit this information, we asked the plant managers the question: "How was the CEO chosen, was he selected as the eldest son or by some other mechanism?" Surprisingly, in many countries, including Brazil, India, and the United Kingdom, the answer was often selection by eldest son, while in others countries such as the United States and Sweden this was very rare. A number of factors, including traditions over leadership succession, estate tax breaks, and the external market for CEOs appear to drive these differences.

Multinational and Export Status also appears to play an important role in determining a firm's management practices. One stylized fact is that multinationals have good management practices wherever they are located - so multinationals in the United States, Brazil, and India all appear to be well run. A second stylized fact is that some countries have relative managerial strengths and weaknesses - for example, the Japanese are better at monitoring and the Americans at incentives/people management - and their multinationals take this with them abroad. In other work with Rafaella Sadun, we show that U.S. multinational affiliates located in Europe were able to use their managerial advantage to make better use of information technology to raise productivity .11

We argue that these managerial differences could account for about half of the superior productivity growth performance in the United States relative to Europe in the decade after 1995. A third stylized fact is that among domestic firms, those that export better managed than non-exporters. Interestingly, these stylized facts are broadly consistent with a wide range of recent trade models.12* Nick Bloom is a Research Associate in the NBER's Programs on Economic Fluctuations and Growth, Monetary Economics, and Productivity, and an Assistant Professor of Economics at Stanford. John Van Reenen is a Research Associate in the NBER's Program on Labor Economics and a Professor of Economics at the London School of Economics.

1. See, for example, L. Foster, J. Haltiwanger, and C. Syverson, "Reallocation, Firm Turnover, and Efficiency: Selection on Productivity or Profitability?" NBER Working Paper No. 11555, August 2005.

2. Notable exceptions include A. Bartel, C. Ichinowski, and K. Shaw, "How Does Information Technology Really Affect Productivity? Plant-Level Comparisons of Product Innovation, Process Improvement, and Worker Skills", NBER Working Paper No. 11773, November 2005, and S. Black and L. Lynch, "How to Compete: The Impact of Workplace Practices and Information Technology on Productivity", NBER Working Paper No. 6120, August 1997, and Review of Economics and Statistics, LXXXIII (3), (2001), pp.434-45.

3. For example, R. Lucas, "On the Size Distribution of Business Firms", Bell Journal of Economics, IX (2), (1978), pp. 508-23; B. Jovanovic "Selection and the Evolution of Industry", Econometrica, L (3), (1982), pp. 649-70; H. Hoppenhayn, "Entry, Exit and Firm Dynamics in Long-Run Equilibrium", Econometrica, LX (5), (1992), pp. 1127-50; or M. Melitz, "The Impact of Trade on Intra-industry Reallocations and Aggregate Productivity Growth", NBER Working Paper No. 8881, April 2002, and Econometrica, LXXI (6), (2003), pp. 1695-725.

4. Y. Mundlak, "Empirical Production Function Free of Management Bias", Journal of Farm Economics, XLIII (1) (1961): pp. 44-56.

5. See N. Bloom and J. Van Reenen, "Measuring and Explaining Management Practices across Firms and Countries", NBER Working Paper No. 12216, May 2006, and Quarterly Journal of Economics, November 2007, pp. 1351-1408; and N. Bloom, R. Sadun, and J. Van Reenen, "Americans Do I.T. Better: U.S. Multinationals and the Productivity Miracle", NBER Working Paper No. 13085, May 2007.

6. We should note that all the co-authors of the management research are European.

7. See N. Bloom and J. Van Reenen, "Measuring and Explaining Management Practices across Firms and Countries."

8. See N. Bloom, T. Kretschmer, and J. Van Reenen, "International Differences in the Business Practices and Productivity of Firms", forthcoming in an NBER book, R. Freedman and K. Shaw, eds; and N. Bloom, C. Genakos, R. Martin, and R. Sadun, "Modern Management: Good for the Environment or Just Hot Air", NBER Working Paper No. 14393, October 2008.

9. We should note "The Office" originated in the UK, where a much larger tail of badly run firms exists. Interestingly, the UK was also the source of "Fawlty Towers", another classic show about bad management practices.

10. M. Bennedsen, K. Nielsen, F. Perez-Gonzales, and D. Wolfenzon, "Inside the Family Firm: the Role of Families in Succession Decisions and Performance", NBER Working Paper No. 12356, July 2006, uses gender of the founder's first-born child as an instrumental variable for family-run firms. They find that the OLS estimates actually underestimate how bad family firms are.

11. See N. Bloom and J. Van Reenen, "Measuring and Explaining Management Practices across Firms and Countries", and N. Bloom, R. Sadun, and J. Van Reenen, "Americans Do I.T. Better: US Multinationals and the Productivity Miracle".

12. See M. Melitz, "The Impact of Trade on Intra-industry Reallocations and Aggregate Productivity Growth"; E. Helpman, M. Melitz, and S. Yeaple, "Export Versus FDI with Heterogeneous Firms", NBER Working Paper No. 9439, January 2003, and American Economic Review, Vol. 94, 2004, pp. 300-16; and A. Burstein and A. Monge, "Foreign Know-how, Firm Control, and the Income of Developing Countries", NBER Working Paper No. 13073, May 2007, forthcoming in Quarterly Journal of Economics.