In this Issue

Does Student Loan Forgiveness Affect Disability Insurance Application?

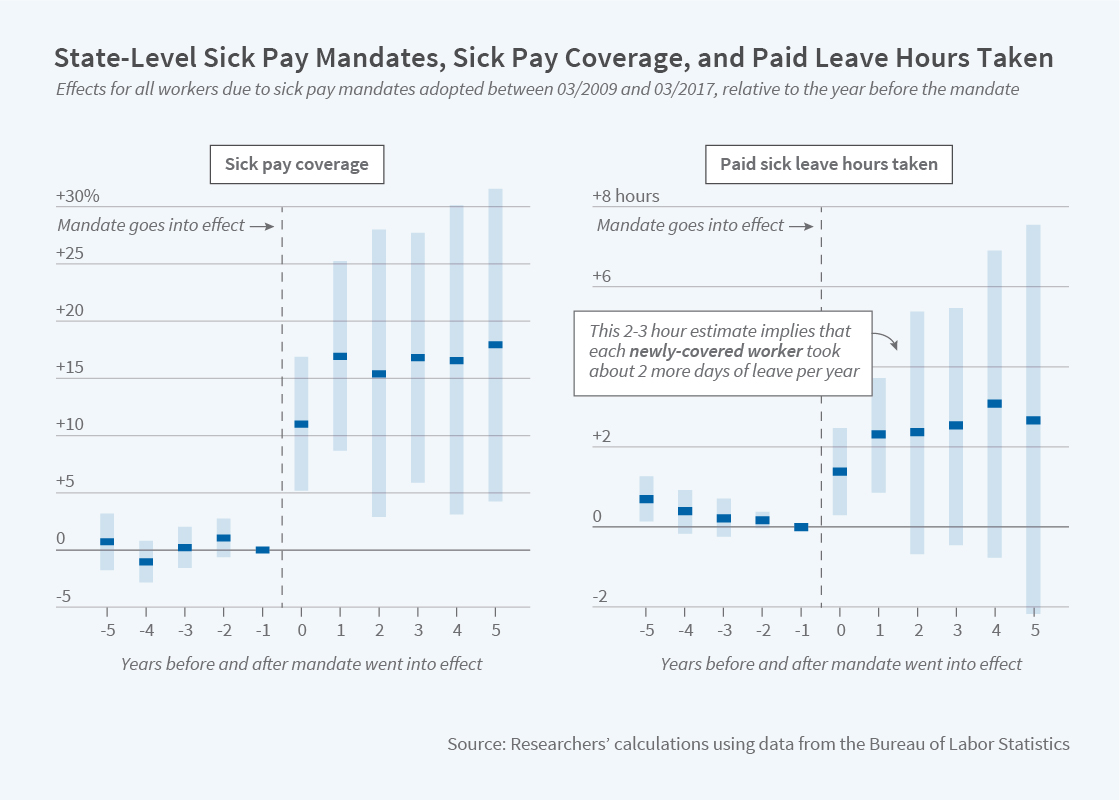

The Effects of Sick Pay Mandates

Training Fellowship

The Bulletin on Retirement and Disability summarizes selected recent Working Papers. It is distributed digitally to economists and other interested persons for informational and discussion purposes. The Bulletin is not copyrighted and may be reproduced freely with attribution of source.

Working Papers produced as part of the NBER's research program are distributed to make preliminary research results available to economists in the hope of encouraging discussion and suggestions for revision before final publication. Neither Working Papers nor issues of the Bulletin on Retirement and Disability are reviewed by the Board of Directors of the NBER.

The Bulletin on Retirement and Disability is edited by Courtney Coile.

To subscribe to receive new issues of the Bulletin on Retirement and Disability, please click here.

To unsubscribe please

click here.

How Bill Timing Affects

Low-Income and Aged Households

Nearly half of all Americans live paycheck to paycheck, with little savings to respond to an unexpected shock like a car repair or hospital bill. Many low-income and elderly households are reliant on government programs to make ends meet. For these households, a mismatch in the timing of when benefits are received and when bills are due can affect the households' ability to pay for necessary goods and services.

In The Impact of Bill Receipt Timing among Low-Income and Aged Households: New Evidence from Administrative Electricity Bill Data, (NBER RDRC Working Paper 19-09), researchers

Lint Barrage,

Ian Chin,

Eric Chyn, and

Justine Hastings explore this issue.

Their study examines how the timing of receipt of Supplemental Nutrition Assistance Program (SNAP) benefits affects the household's ability to pay their electricity bill. SNAP is the largest food security program in the US, with 40 million individuals served and expenditures of $65 Billion in 2018. While previous research has established that households experience greater financial distress when there is a mismatch between the timing of Social Security or Disability Insurance benefit receipt and the due dates for mortgage, auto, or credit card payments, it is unknown whether the timing of SNAP benefits is similarly important.

SNAP benefits are loaded on to an electronic benefits transfer (EBT) card, which can be used to purchase food items at grocery stores and other retailers. SNAP payments are made on the first day of the month in the state for which the authors have data. The authors obtain account-level data from an anonymous electricity provider serving a state in New England. These data include the date when electricity bills are received and due, as well as information on payments. The authors use these data to explore whether receiving a bill closer to the timing of SNAP receipt affects whether households pay their bills in full or experience collections activity or disconnection of service for failure to pay.

The authors find that in low-income neighborhoods, households who receive their electricity bills within one day before or after the first of the month are 36 percent less likely to have a late payment, have 67 percent lower outstanding balances, and are 64 percent less likely to have their electricity disconnected than are similar households who receive electricity bills at other times of the month. In higher-income neighborhoods, where households are less likely to be eligible for SNAP benefits and have greater financial resources in general, the relationship between the timing of electricity bill receipt and payment outcomes nearly vanishes.

The authors look for similar patterns among those living in neighborhoods with a high concentration of elderly residents. Nearly all elderly residents receive Social Security benefits, typically at a different time than they receive SNAP benefits (if eligible), since the distribution of Social Security benefits occurs throughout the month. Focusing on high-elderly low-income neighborhoods produces results that are similar to the original results but up to one-third smaller, as might be expected given older residents' access to Social Security income.

In concluding, the authors say, "our results suggest that, for low-income households, timing of income from government benefits and the timing of bills may have long-run consequences. If bills are not received when income is received, households are more likely to miss payments, which may compound into disconnections which may further impact family financial and health outcomes. In the case of electricity bills, moving bill receipt to coincide with SNAP benefit receipt could improve repayment rates. This could help low-income families avoid poverty traps, but also lower electricity rates for all rate payers in regulated markets, since collection and electricity service disruption are costly and must by covered by regulated electricity rates."

The research reported herein was performed pursuant to grant #RDR18000003 from the US Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of NBER, SSA or any agency of the Federal Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.